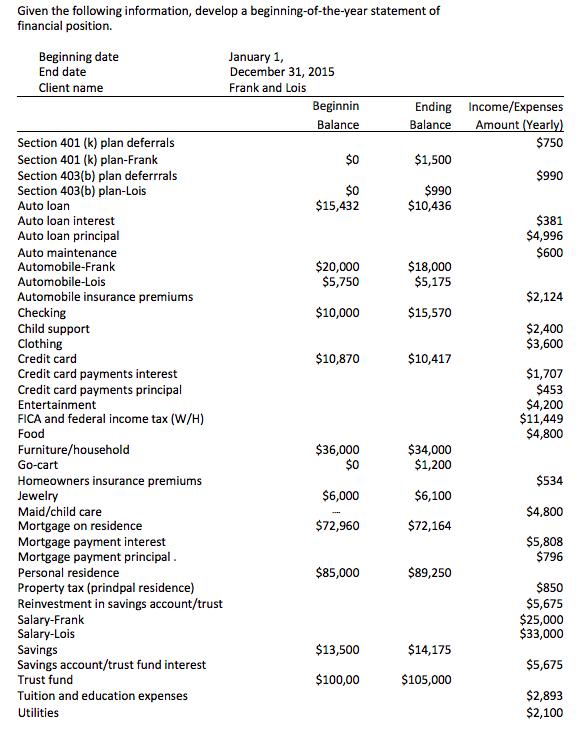

Question: Given the following information, develop a beginning-of-the-year statement of financial position. Beginning date End date Client name Section 401(k) plan deferrals Section 401(k) plan-Frank

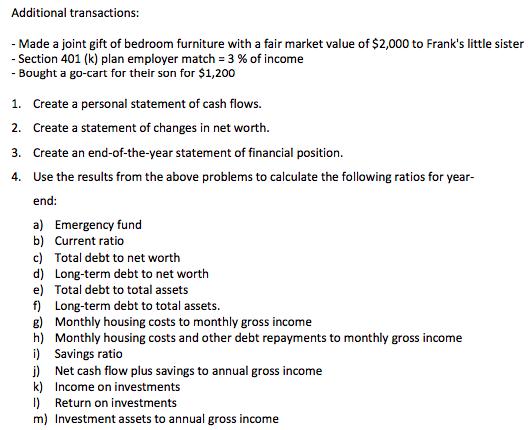

Given the following information, develop a beginning-of-the-year statement of financial position. Beginning date End date Client name Section 401(k) plan deferrals Section 401(k) plan-Frank Section 403(b) plan deferrrals Section 403(b) plan-Lois Auto loan Auto loan interest Auto loan principal Auto maintenance Automobile-Frank Automobile-Lois Automobile insurance premiums Checking Child support Clothing Credit card Credit card payments interest Credit card payments principal Entertainment FICA and federal income tax (W/H) Food Furniture/household Go-cart Homeowners insurance premiums Jewelry Maid/child care Mortgage on residence Mortgage payment interest Mortgage payment principal. Personal residence Property tax (prindpal residence) Reinvestment in savings account/trust Salary-Frank Salary-Lois Savings Savings account/trust fund interest Trust fund Tuition and education expenses Utilities January 1, December 31, 2015 Frank and Lois Beginnin Balance $0 $0 $15,432 $20,000 $5,750 $10,000 $10,870 $36,000 $0 $6,000 $72,960 $85,000 $13,500 $100,00 Ending Income/Expenses Amount (Yearly) Balance $750 $990 $1,500 $990 $10,436 $18,000 $5,175 $15,570 $10,417 $34,000 $1,200 $6,100 $72,164 $89,250 $14,175 $105,000 $381 $4,996 $600 $2,124 $2,400 $3,600 $1,707 $453 $4,200 $11,449 $4,800 $534 $4,800 $5,808 $796 $850 $5,675 $25,000 $33,000 $5,675 $2,893 $2,100 Additional transactions: - Made a joint gift of bedroom furniture with a fair market value of $2,000 to Frank's little sister - Section 401(k) plan employer match = 3 % of income - Bought a go-cart for their son for $1,200 1. Create a personal statement of cash flows. 2. Create a statement of changes in net worth. 3. Create an end-of-the-year statement of financial position. 4. Use the results from the above problems to calculate the following ratios for year- end: a) b) Current ratio Emergency fund c) Total debt to net worth d) Long-term debt to net worth e) Total debt to total assets f) Long-term debt to total assets. g) Monthly housing costs to monthly gross income h) Monthly housing costs and other debt repayments to monthly gross income i) Savings ratio j) Net cash flow plus savings to annual gross income k) Income on investments 1) Return on investments m) Investment assets to annual gross income

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Personal Statement of Cash Flows Operating Activities SalaryFrank 85000 SalaryLois 72960 Child support 6000 Interest income 850 Auto loan interest 381 Mortgage payment interest 4200 FICA and federal i... View full answer

Get step-by-step solutions from verified subject matter experts