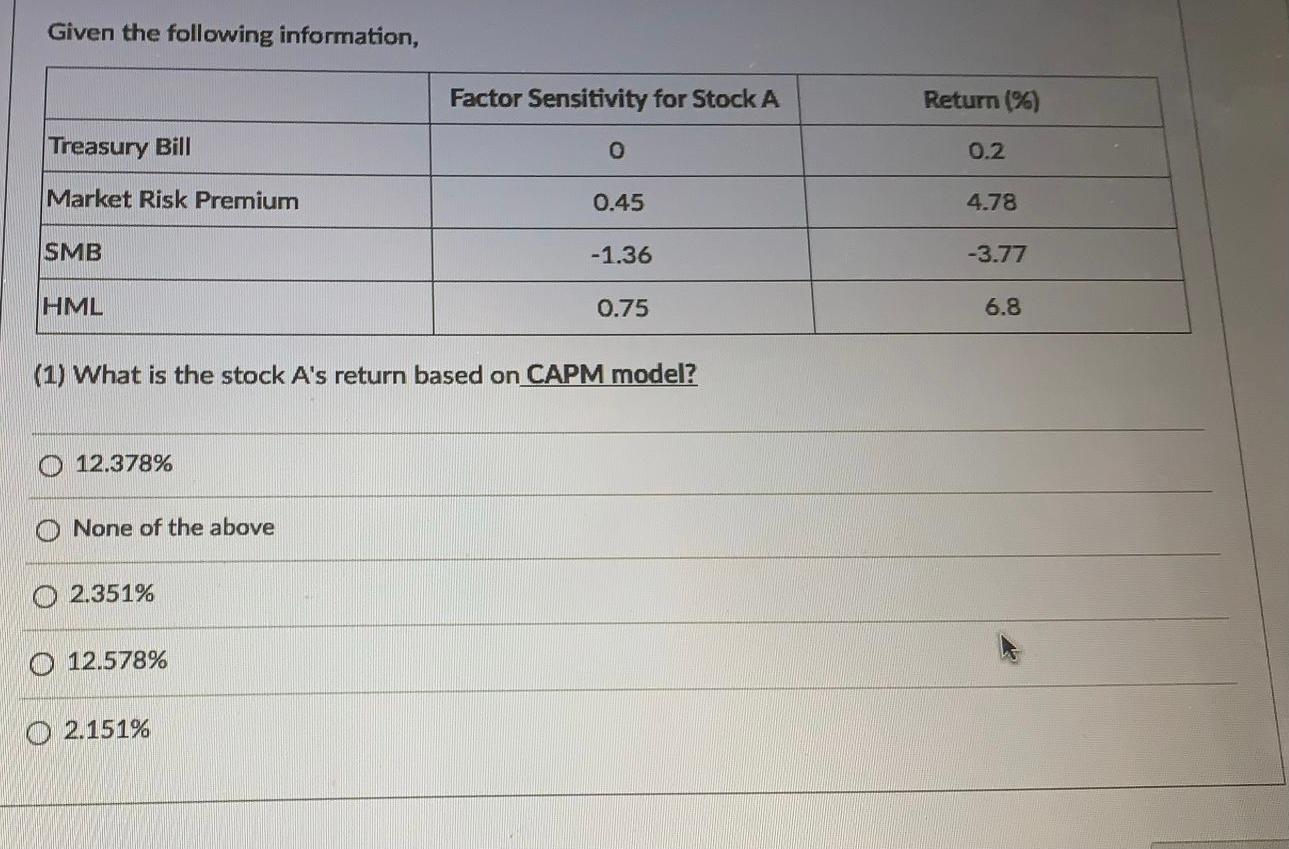

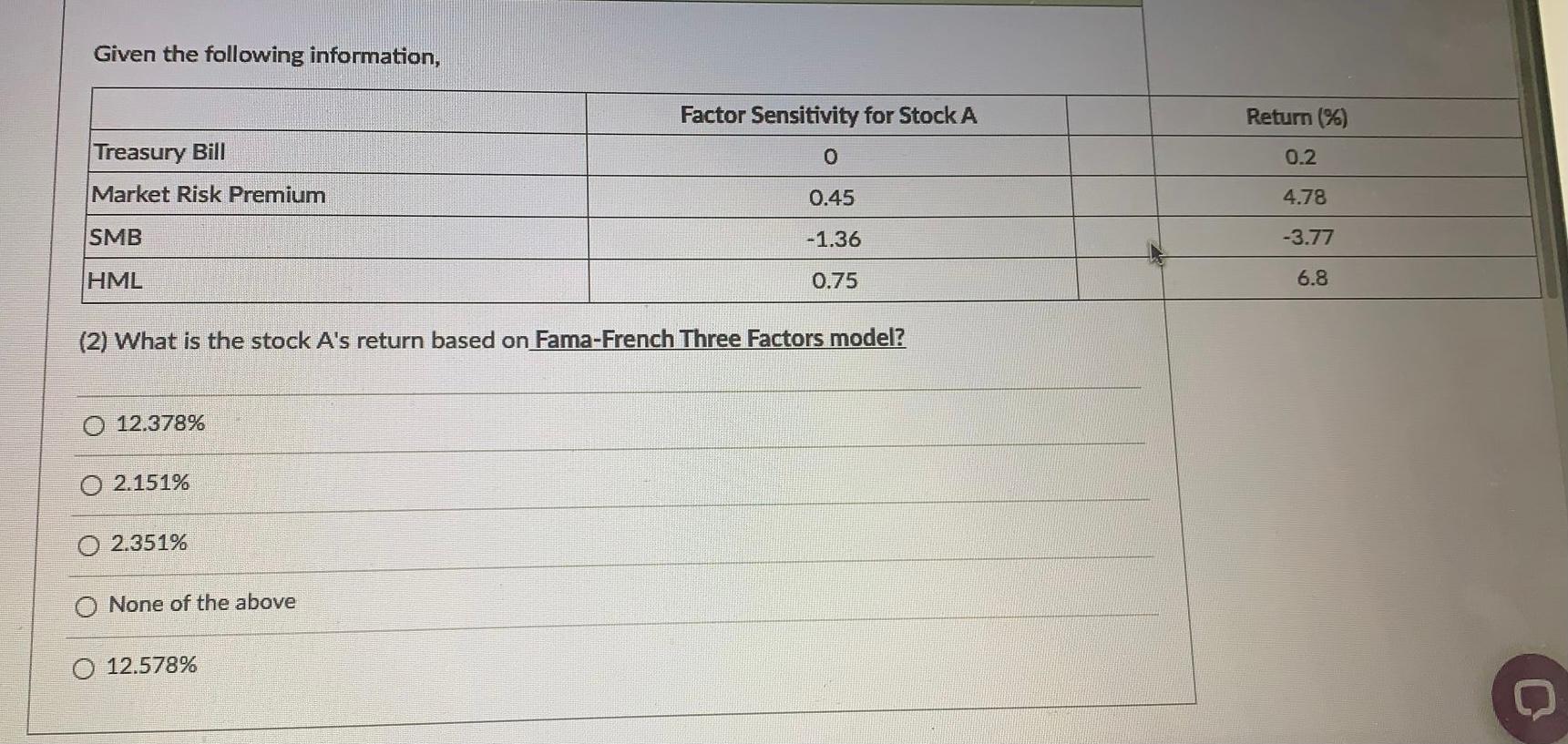

Question: Given the following information, Factor Sensitivity for Stock A Return (% Treasury Bill 0 0.2 Market Risk Premium 0.45 4.78 SMB -1.36 -3.77 HML 0.75

Given the following information, Factor Sensitivity for Stock A Return (% Treasury Bill 0 0.2 Market Risk Premium 0.45 4.78 SMB -1.36 -3.77 HML 0.75 6.8 (1) What is the stock A's return based on CAPM model? 12.378% None of the above 2.351% 0 12.578% 0 2.151% Given the following information, Factor Sensitivity for Stock A Return (%) Treasury Bill 0 0.2 Market Risk Premium 0.45 4.78 SMB -1.36 -3.77 HML 0.75 6.8 (2) What is the stock A's return based on Fama-French Three Factors model? O 12.378% 2.151% 2.351% None of the above 12.578%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts