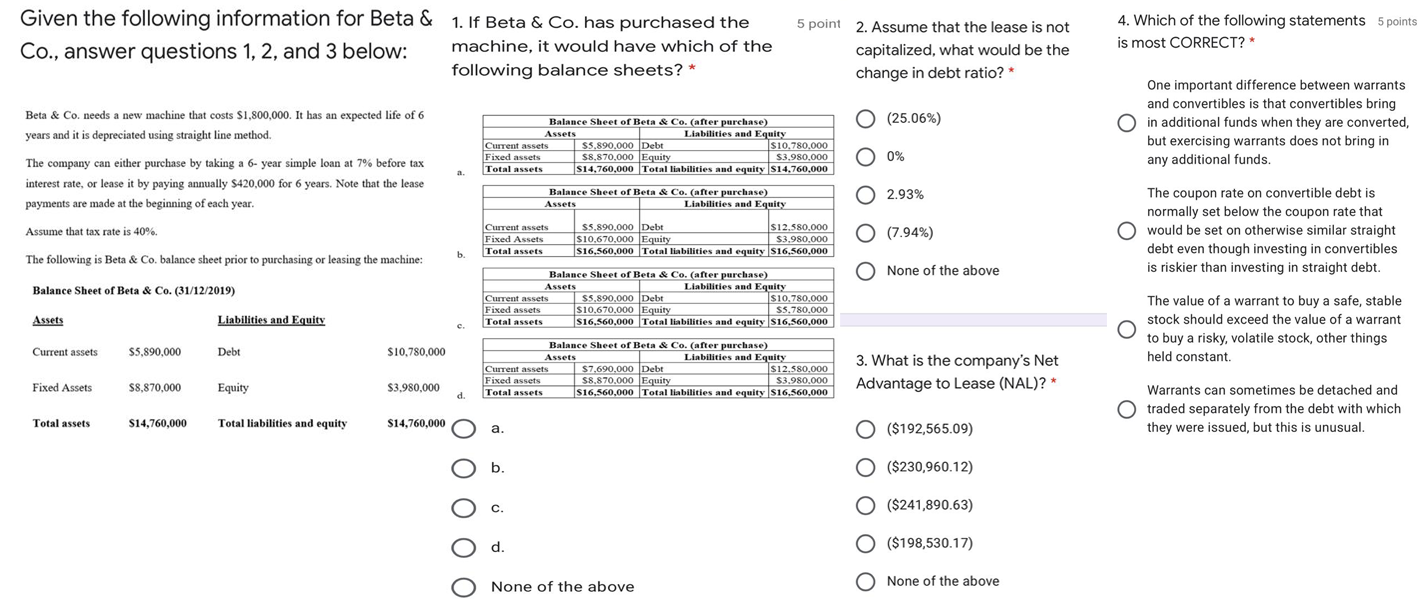

Question: Given the following information for Beta & 1. If Beta & Co. has purchased the Co., answer questions 1, 2, and 3 below: machine, it

Given the following information for Beta & 1. If Beta & Co. has purchased the Co., answer questions 1, 2, and 3 below: machine, it would have which of the following balance sheets? * 5 point 2. Assume that the lease is not capitalized, what would be the change in debt ratio? * 4. Which of the following statements 5 points is most CORRECT?* (25.06%) Beta & Co. needs a new machine that costs $1,800,000. It has an expected life of 6 years and it is depreciated using straight line method. Balance Sheet of Beta & Co. (after purchase) Assets Liabilities and Equity Current assets $5.890.000 Debt S10.780,000 Fixed assets $8.870.000 Equity $3.980.000 Total assets S14,760,000 Total liabilities and equity S14.760,000 One important difference between warrants and convertibles is that convertibles bring additional funds when they are converted, but exercising warrants does not bring in any additional funds. 0% The company can either purchase by taking a 6- year simple loan at 7% before tax interest rate, or lease it by paying annually $420,000 for 6 years. Note that the lease payments are made at the beginning of each year. Balance Sheet of Beta & Co. (after purchase) Assets Liabilities and Equity O 2.93% Assume that tax rate is 40%. Current assets Fixed Assets Total assets $5.890.000 Debt $12.580.000 $10,670,000 Equity $3.980.000 $16,560,000 Total liabilities and equity S16,560,000 O (7.94%) o The coupon rate on convertible debt is normally set below the coupon rate that would be set on otherwise similar straight debt even though investing in convertibles is riskier than investing in straight debt b. The following is Beta & Co. balance sheet prior to purchasing or leasing the machine: None of the above Balance Sheet of Beta & Co. (31/12/2019) Balance Sheet of Beta & Co. (after purchase) Assets Liabilities and Equity Current assets $5.890,000 Debt $10.780.000 Fixed assets S10,670.000 Equity S5.780.000 Total assets S16,560,000 Total liabilities and equity S16,560,000 Assets Liabilities and Equity c. The value of a warrant to buy a safe, stable stock should exceed the value of a warrant to buy a risky, volatile stock, other things held constant. Current assets 55,890,000 Debt $10.780,000 Balance Sheet of Beta & Co. (after purchase) Assets Liabilities and Equity Current assets $7.690.000 Debt S12.580.000 Fixed assets S8.870.000 Equity $3.980.000 Total assets S16,560,000 Total liabilities and equity S16,560,000 3. What is the company's Net Advantage to Lease (NAL)?* Fixed Assets $8,870,000 Equity $3.980,000 d. Warrants can sometimes be detached and traded separately from the debt with which they were issued, but this is unusual. Total assets $14,760,000 Total liabilities and equity $14,760,000 a. ($192,565.09) b. ($230,960.12) O O O O C. O ($241,890.63) d. O ($198,530.17) o None of the above O None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts