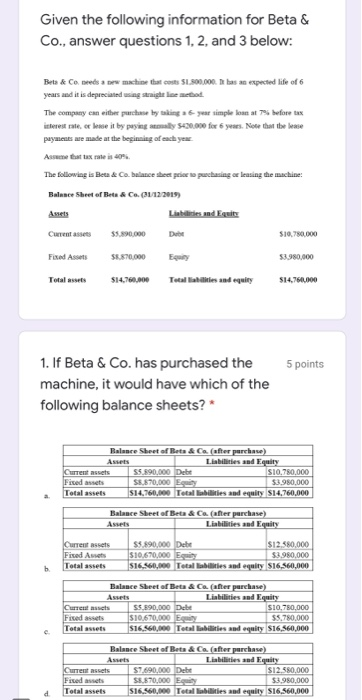

Question: Given the following information for Beta & Co., answer questions 1, 2, and 3 below: Bets & Co. needs a new machine that costs $1.500.000.

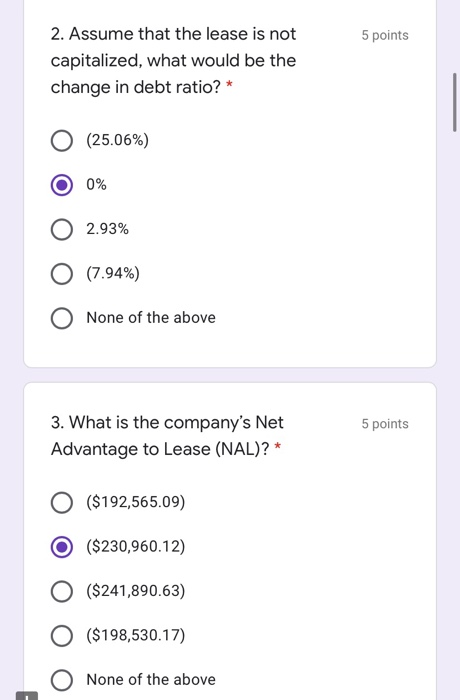

Given the following information for Beta & Co., answer questions 1, 2, and 3 below: Bets & Co. needs a new machine that costs $1.500.000. tbas an expected life of 6 years and it is deprecated using right ne method The company can either purchase by taking 26 year simple loan at 7% before tax interest rate or lose it by paying may 5630.000 for 5 years. Note that the lease payments are made at the beginning of each yea Assume that tax rate is 40% The following is Beta & Co. balance sheet price to purchasing or leasing the machine Balance Sheet of Bete & Co. (31/12/2015) Assets Linies and East Current assets $5.890,000 Dube $10.750.000 Fixed Assets 56.70.000 Egy 53.980,000 Total $14.760.000 Total and equity $14.7600.000 5 points 1. If Beta & Co. has purchased the machine, it would have which of the following balance sheets? * Balance Sheet of Rets & Ca(after purchase) Assets Liabilities and Equity Current assets 55.890,000 Debe SIO.780,000 Fixed assets 58.870,000 $3.980,000 Total assets $14.760,000 Total abilities and equity S14,760,000 Balance Sheet of Beta & Co. (after purchase) Assets Liabilities and Equity Current assets Fixed Assets Total assets 55.890,000 Debe S12580,000 $10.670,000 Equity $3.980.000 $16.560,000 Total abilities and equity $16,560,000 h Balance Sheet of Bets & Co. (after purchase) Assets Liabilities and Equity Current assets $5.990,000 Dube S10,780,000 Fixed assets $10.670.000 Eur $5.780,000 Total assets $16.560,000 Total abilities and equity $16,560,000 Balance Sheet of Bets & C (after purchase) Assets Liabilities and Equity Current assets 57.690.000 Debe S12.580,000 Fixed 58.870,000 $3.980,000 Total assets $16.560,000 Total abilities and equity S16,560,000 5 points 2. Assume that the lease is not capitalized, what would be the change in debt ratio?* (25.06%) 0% 02.93% (7.94%) None of the above 5 points 3. What is the company's Net Advantage to Lease (NAL)?* ($192,565.09) ($230,960.12) ($241,890.63) ($198,530.17) O None of the above Given the following information for Beta & Co., answer questions 1, 2, and 3 below: Bets & Co. needs a new machine that costs $1.500.000. tbas an expected life of 6 years and it is deprecated using right ne method The company can either purchase by taking 26 year simple loan at 7% before tax interest rate or lose it by paying may 5630.000 for 5 years. Note that the lease payments are made at the beginning of each yea Assume that tax rate is 40% The following is Beta & Co. balance sheet price to purchasing or leasing the machine Balance Sheet of Bete & Co. (31/12/2015) Assets Linies and East Current assets $5.890,000 Dube $10.750.000 Fixed Assets 56.70.000 Egy 53.980,000 Total $14.760.000 Total and equity $14.7600.000 5 points 1. If Beta & Co. has purchased the machine, it would have which of the following balance sheets? * Balance Sheet of Rets & Ca(after purchase) Assets Liabilities and Equity Current assets 55.890,000 Debe SIO.780,000 Fixed assets 58.870,000 $3.980,000 Total assets $14.760,000 Total abilities and equity S14,760,000 Balance Sheet of Beta & Co. (after purchase) Assets Liabilities and Equity Current assets Fixed Assets Total assets 55.890,000 Debe S12580,000 $10.670,000 Equity $3.980.000 $16.560,000 Total abilities and equity $16,560,000 h Balance Sheet of Bets & Co. (after purchase) Assets Liabilities and Equity Current assets $5.990,000 Dube S10,780,000 Fixed assets $10.670.000 Eur $5.780,000 Total assets $16.560,000 Total abilities and equity $16,560,000 Balance Sheet of Bets & C (after purchase) Assets Liabilities and Equity Current assets 57.690.000 Debe S12.580,000 Fixed 58.870,000 $3.980,000 Total assets $16.560,000 Total abilities and equity S16,560,000 5 points 2. Assume that the lease is not capitalized, what would be the change in debt ratio?* (25.06%) 0% 02.93% (7.94%) None of the above 5 points 3. What is the company's Net Advantage to Lease (NAL)?* ($192,565.09) ($230,960.12) ($241,890.63) ($198,530.17) O None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts