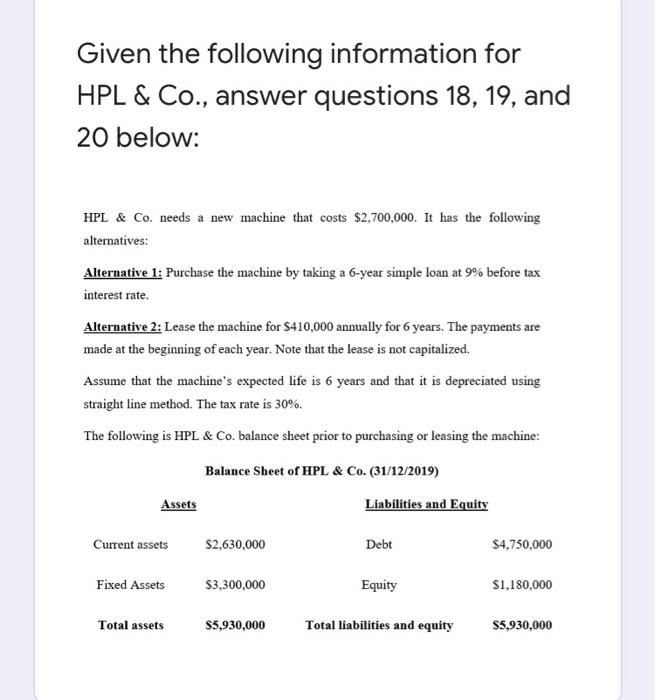

Question: Given the following information for HPL & Co., answer questions 18, 19, and 20 below: HPL & Co. needs a new machine that costs $2,700,000.

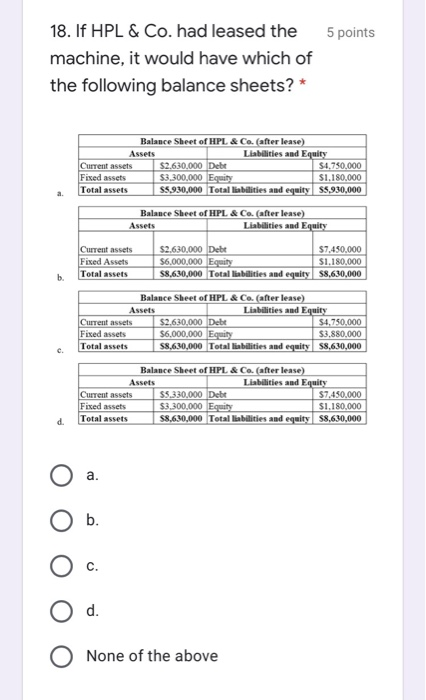

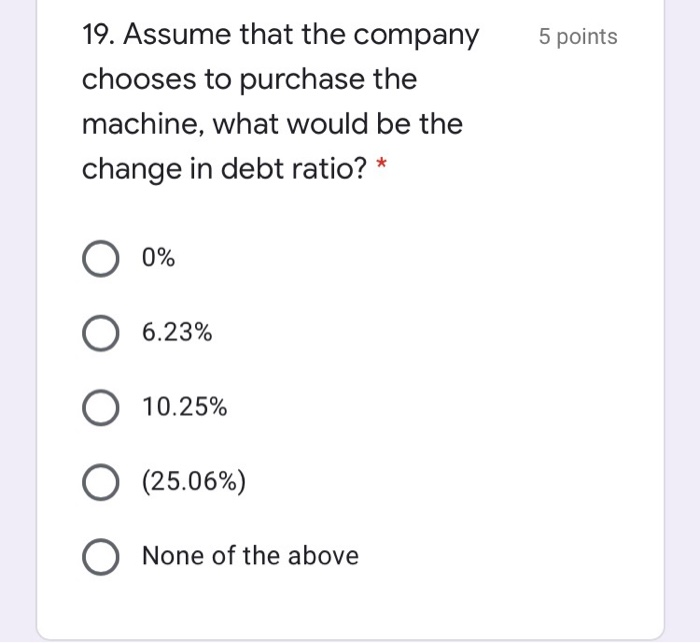

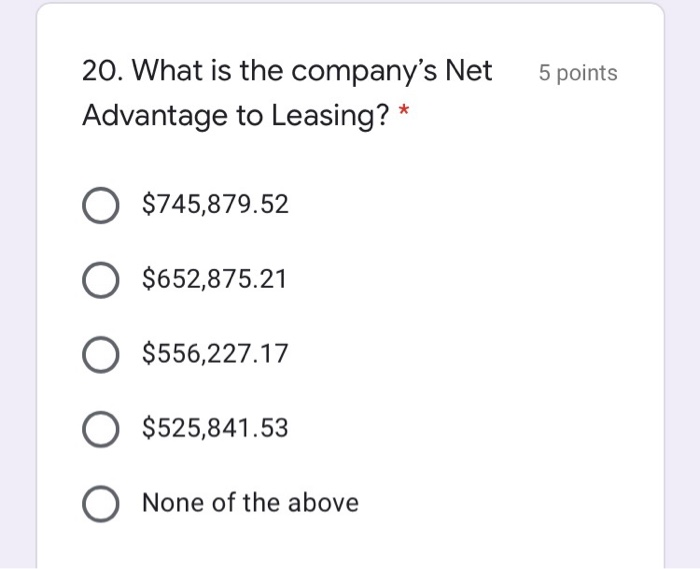

Given the following information for HPL & Co., answer questions 18, 19, and 20 below: HPL & Co. needs a new machine that costs $2,700,000. It has the following alternatives: Alternative 1: Purchase the machine by taking a 6-year simple loan at 9% before tax interest rate. Alternative 2: Lease the machine for $410,000 annually for 6 years. The payments are made at the beginning of each year. Note that the lease is not capitalized. Assume that the machine's expected life is 6 years and that it is depreciated using straight line method. The tax rate is 30%. The following is HPL & Co. balance sheet prior to purchasing or leasing the machine: Balance Sheet of HPL & Co. (31/12/2019) Liabilities and Equity Assets Current assets $2,630,000 Debt $4,750,000 Fixed Assets $3,300,000 Equity $1,180,000 Total assets $5,930,000 Total liabilities and equity $5,930,000 5 points 18. If HPL & Co. had leased the machine, it would have which of the following balance sheets? * Balance Sheet of HPL & Co. (after lease) Assets Liabilities and Equity Current assets $2.630,000 Debt $4,750,000 Fixed assets $3.300,000 Equity $1.180.000 Total assets $5.930,000 Total liabilities and equity S5,930,000 Balance Sheet of HPL & Co. (after lease) Assets Liabilities and Equity b. Current assets $2.630.000 Debt $7.450,000 Fixed Assets $6.000.000 Equity $1.180.000 Total assets $8,630,000 Total liabilities and equity 58,630,000 Balance Sheet of HPL & Co. (after lease) Assets Liabilities and Equity Current assets $2,630,000 Debt $4,750,000 Fixed assets $6,000,000 Equity $3.880,000 Total assets $8,630,000 Total liabilities and equity 88,630,000 Balance Sheet of HPL & Co. (after lease) Assets Liabilities and Equity Current assets $5.330,000 Debt $7.450.000 Fixed assets $3.300.000 Equity $1.180,000 Total assets $8,630,000 Total liabilities and equity 58,630,000 c. d. a. b. d. O None of the above 5 points 19. Assume that the company chooses to purchase the machine, what would be the change in debt ratio? * 0% O 6.23% 10.25% O (25.06%) None of the above 5 points 20. What is the company's Net Advantage to Leasing? * $745,879.52 $652,875.21 $556,227.17 O $525,841.53 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts