Question: Given the following information from an amortization table for December 31, 2017, prepare the journal entry to record the accrual of interest at year end

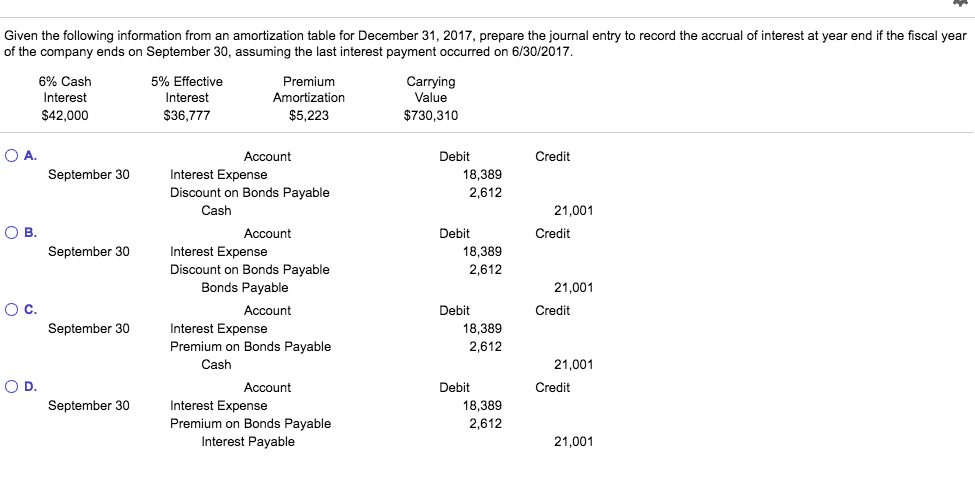

Given the following information from an amortization table for December 31, 2017, prepare the journal entry to record the accrual of interest at year end if the fiscal year of the company ends on September 30, assuming the last interest payment occurred on 6/30/2017 6% Cash Interest $42,000 5% Effective Interest $36,777 Premium Amortization $5,223 Carrying Value $730,310 A. Account Debit Credit September 30 Interest Expense Discount on Bonds Payable 18,389 2,612 21,001 Credit Cash Account Debit September 30 Interest Expense 18,389 2,612 Discount on Bonds Payable Bonds Payable 21,001 Credit Account Debit September 30 Interest Expense Premium on Bonds Payable 18,389 2,612 21,001 Credit Cash Account Debit September 30 Interest Expense Premi 18,389 2,612 ium on Bonds Payable Interest Payable 21,001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts