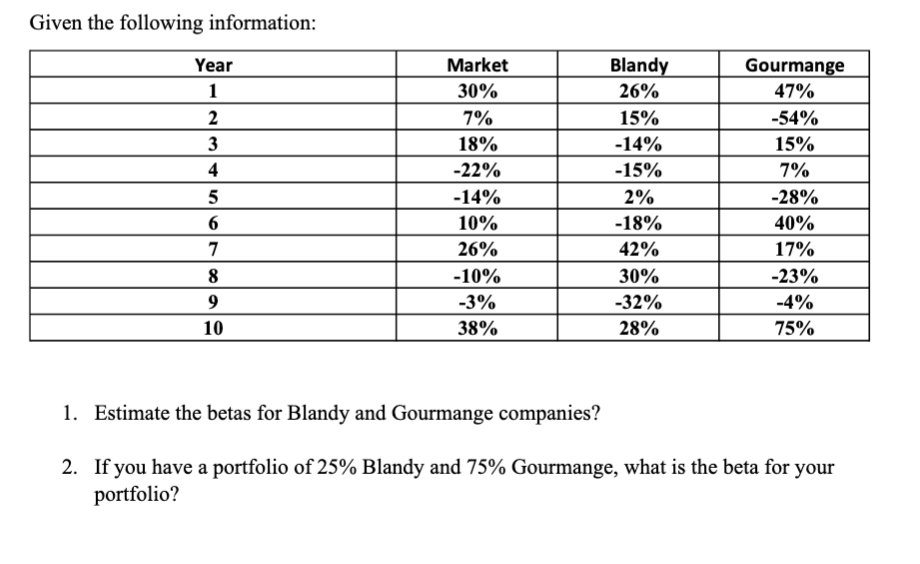

Question: Given the following information: Year 1 2 3 4 5 6 7 8 9 10 Market 30% 7% 18% -22% -14% 10% 26% -10% -3%

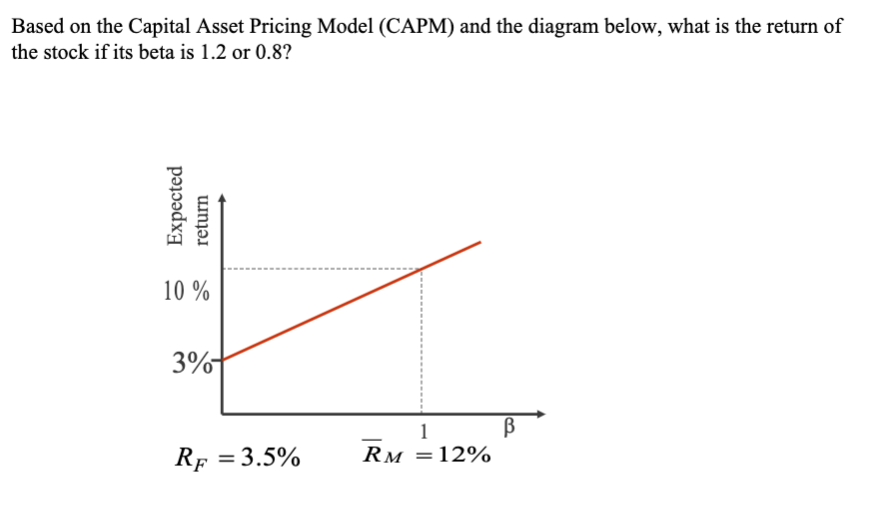

Given the following information: Year 1 2 3 4 5 6 7 8 9 10 Market 30% 7% 18% -22% -14% 10% 26% -10% -3% 38% Blandy 26% 15% -14% -15% 2% -18% 42% 30% -32% 28% Gourmange 47% -54% 15% 7% -28% 40% 17% -23% -4% 75% 1. Estimate the betas for Blandy and Gourmange companies? 2. If you have a portfolio of 25% Blandy and 75% Gourmange, what is the beta for your portfolio? Based on the Capital Asset Pricing Model (CAPM) and the diagram below, what is the return of the stock if its beta is 1.2 or 0.8? Expected return 10 % 3% 1 B RM = 12% RF = 3.5%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock