Question: Need help solving for part c). Not sure what Excel function to use and how it needs to be set up. %) P11-43 (similar to)

Need help solving for part c). Not sure what Excel function to use and how it needs to be set up.

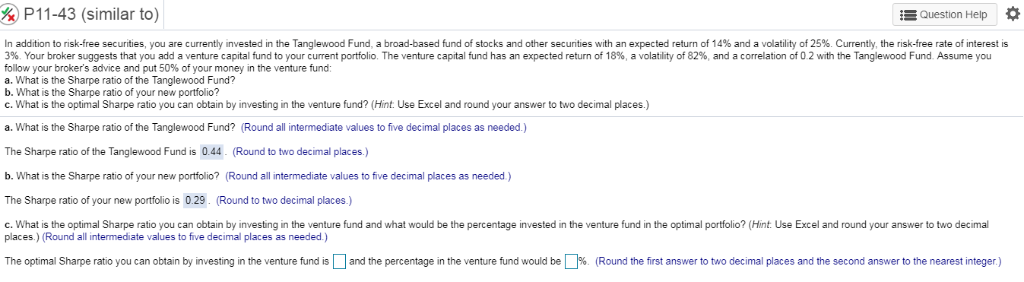

%) P11-43 (similar to) Question Help * In addition to risk-free securities you are currenty invested in the anglewood Fund, a broad-based und o stocks and other secur ties with an expected return o 14% and a volatil 0125% urrent the risk-free rate ofinterest s 3% Your broker suggests that you add a venture capital fund to your current portfolio. The venture capita fund has an expected return of 18%, a volatility o 82% and a correlation of 0 2 with he Tangle ood Fund Assume you follow your broker's advice and put 50% of your money in the venture fund: a. What is the Sharpe ratio of the Tanglewood Fund? b. What is the Sharpe ratio of your new portfolio? c. What is the optial Sharpe ratio you can obtain by investing in the venture fund? (Hint: Use Excel and round your answer to two decimal places.) a. What is the Sharpe ratio of the Tanglewood Fund? (Round all intermediate values to five decimal places as needed.) The Sharpe ratio of the Tanglewood Fund is 0.44 (Round to two decimal places.) b. What is the Sharpe ratio of your new portfolio? (Round all intermediate values to five decimal places as needed) The Sharpe ratio of your new portfolio is 0.29(Round to two decimal places.) c. What is the optimal Sharpe ratio you can obtain by investing in the venture fund and what would be the percentage invested in the venture fund in the optimal portfolio? (Hint. Use Excel and round your answer to two decimal places.) (Round all intermediate values to five decimal places as needed.) The optimal Sharpe ratio you can obtain by investing in the venture fund isand the percentage in the venture fund would be Round the first answer to two decimal places and the second answer to the nearest integer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts