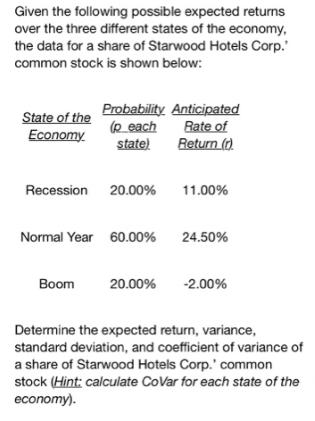

Question: Given the following possible expected returns over the three different states of the economy, the data for a share of Starwood Hotels Corp. common

Given the following possible expected returns over the three different states of the economy, the data for a share of Starwood Hotels Corp." common stock is shown below: State of the Economy Probability Anticipated Rate of Return (r) (p each state) Recession 20.00% Boom 11.00% Normal Year 60.00% 24.50% 20.00% -2.00% Determine the expected return, variance, standard deviation, and coefficient of variance of a share of Starwood Hotels Corp.' common stock (Hint: calculate CoVar for each state of the economy).

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

To calculate the expected return variance standard deviation and coefficient of variance for a share ... View full answer

Get step-by-step solutions from verified subject matter experts