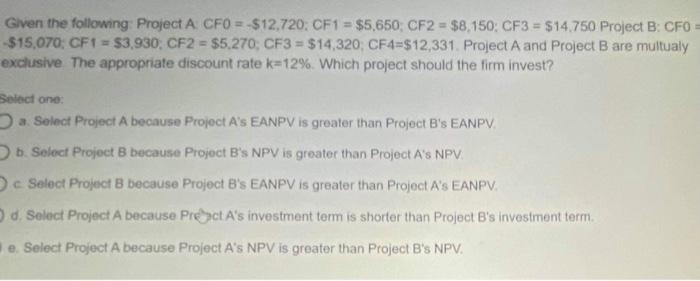

Question: Given the following: Project A CF0 = $12,720CF1 = $5,650 CF2 = $8,150: CF3 = $14.750 Project B: CFO = $15,070; CF1 = $3.930, CF2

Given the following: Project A CF0 = $12,720CF1 = $5,650 CF2 = $8,150: CF3 = $14.750 Project B: CFO = $15,070; CF1 = $3.930, CF2 = $5,270, CF3 = $14,320, CF4=$12,331. Project A and Project B are multualy exclusive The appropriate discount rate k=12%. Which project should the firm invest? Select one: a. Select Project A because Project A's EANPV is greater than Project B's EANPV. 1. Select Project B because Project B's NPV is greater than Project A's NPV. Select Project B because Project B's EANPV is greater than Project A's EANPV. d. Select Project A because Pract A's investment term is shorter than Project B's investment term. e. Select Project A because Project A's NPV is greater than Project B's NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts