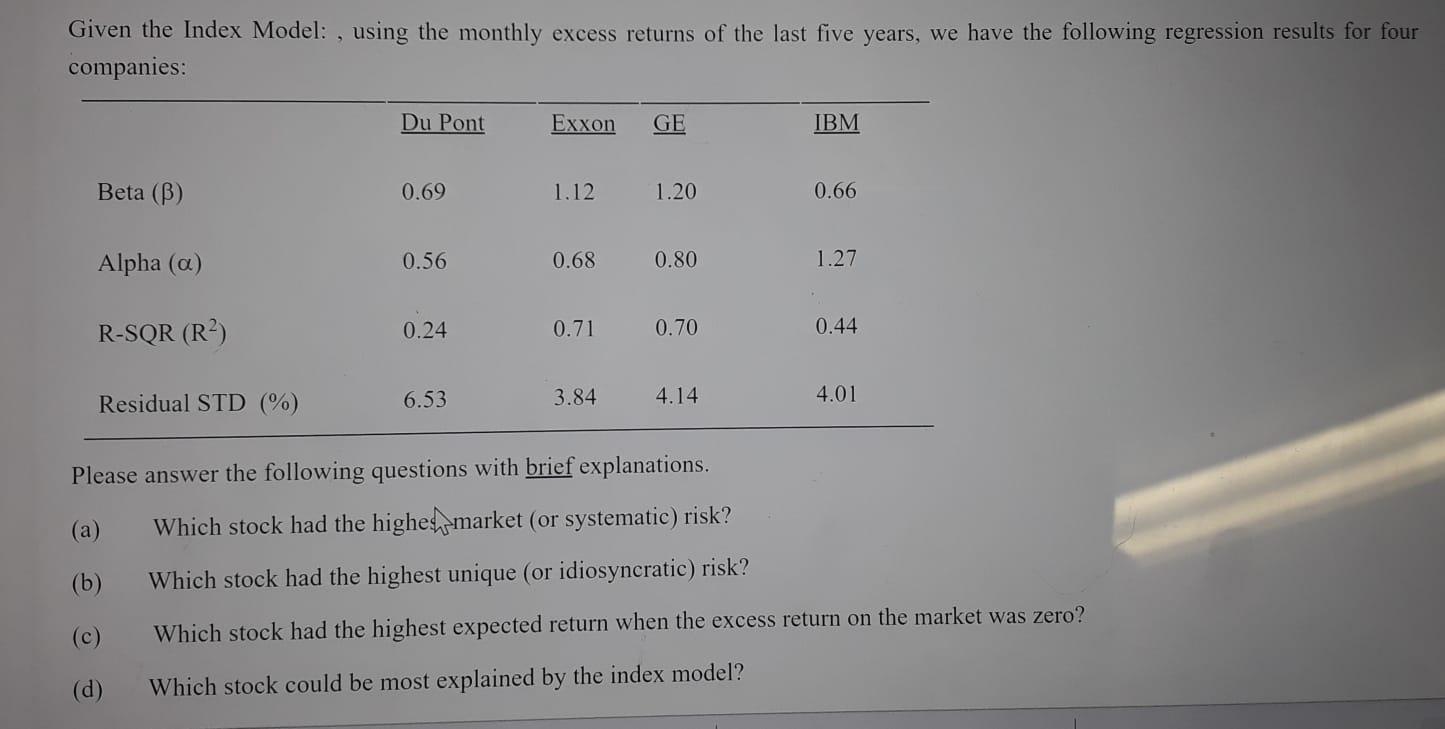

Question: Given the Index Model: , using the monthly excess returns of the last five years, we have the following regression results for four companies: Du

Given the Index Model: , using the monthly excess returns of the last five years, we have the following regression results for four companies: Du Pont Exxon GE IBM Beta (B) 0.69 1.12 1.20 0.66 Alpha (a) 0.56 0.68 0.80 1.27 R-SQR (R) 0.24 0.71 0.70 0.44 6.53 Residual STD (%) 3.84 4.14 4.01 Please answer the following questions with brief explanations. (a) Which stock had the highesh market (or systematic) risk? (b) Which stock had the highest unique (or idiosyncratic) risk? (C) Which stock had the highest expected return when the excess return on the market was zero? (d) Which stock could be most explained by the index model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts