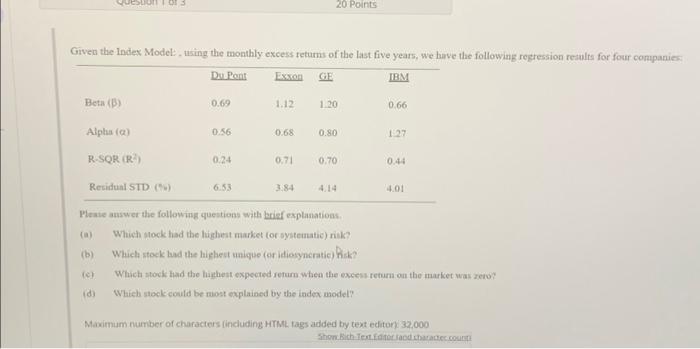

Question: Given the Index Model:, using the monthly excess returns of the last five years, we have the following regression results for four companies: Du Pont

Given the Index Model:, using the monthly excess returns of the last five years, we have the following regression results for four companies: Du Pont Exxon GE IBM Beta (B) Alpha () R-SQR (R) Residual STD (%) (b) 0.69 (c) (d) 0.56 0.24 6.53 1.12 0.68 0.71 20 Points 3.84 1.20 0.80 0.70 4.14 0.66 1.27 0.44 Please answer the following questions with brief explanations. (a) Which stock had the highest market (or systematic) risk? Which stock had the highest unique (or idiosyncratic) fisk? Which stock had the highest expected return when the excess return on the market was zero? Which stock could be most explained by the index model? 4.01 Maximum number of characters (including HTML tags added by text editor): 32,000 Show Rich-Text Editor (and character count)

Given the Index Model, tuing the monthly excess teturns of the last five years, we have the following regression results for four corapanies: Pleste auswer the following quentions with briaf explanations. (a) Which stock had the highest market (or systematic) rikk? (b) Which stock tad the highest unique (or idiosyncratic) hisk? (c) Which stock had the highest expected returs when the excess return on the market was zero? (d) Whieh stock could be nost oxplained by the index model? Maximum number of characters fincluding HTML tags added by text editoni 32,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock