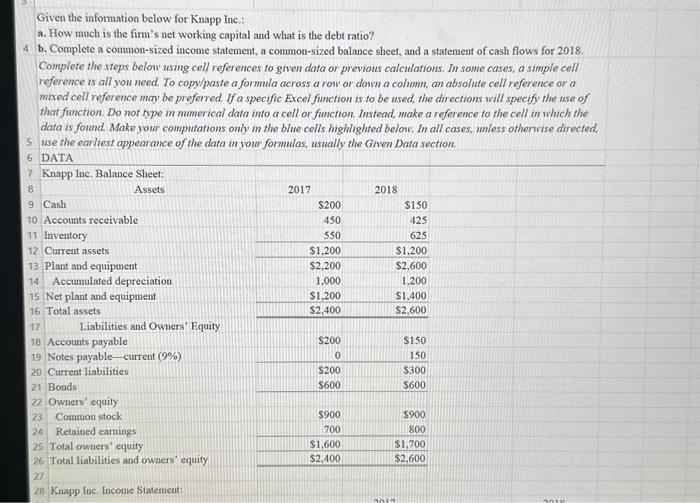

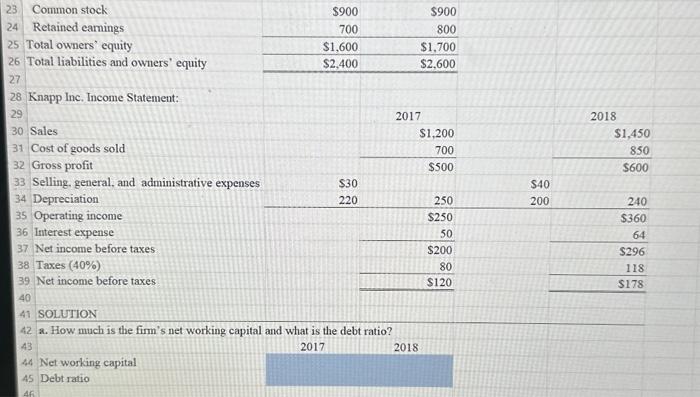

Question: Given the information below for Knapp Inc.: a. How much is the firm's net working capital and what is the debt ratio? b. Complete a

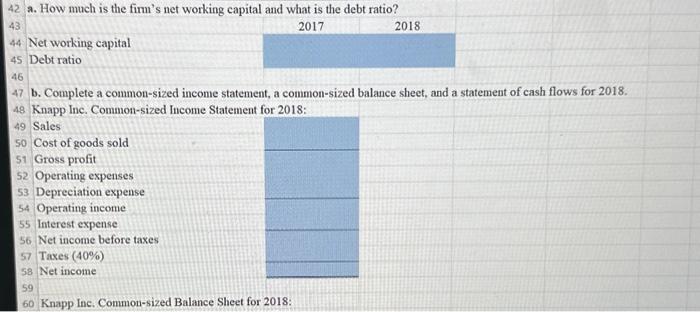

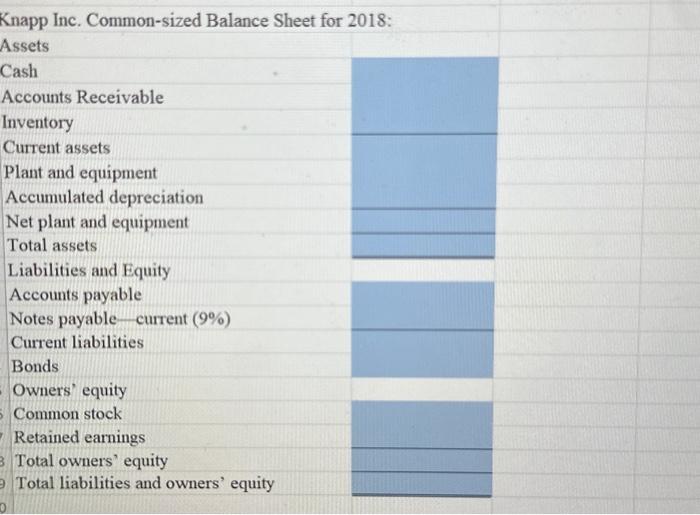

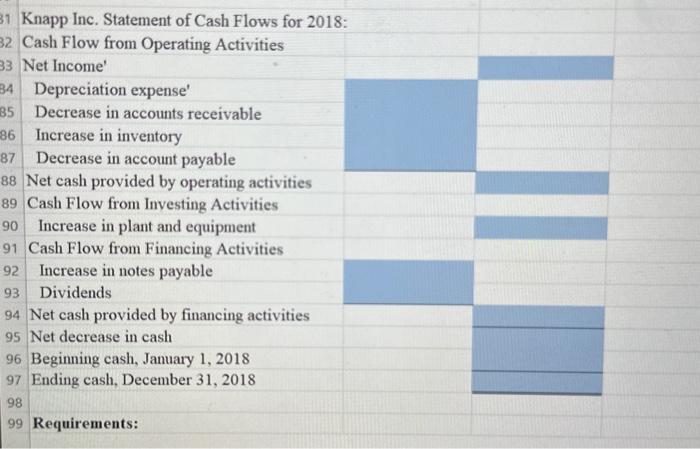

Given the information below for Knapp Inc.: a. How much is the firm's net working capital and what is the debt ratio? b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flows for 2018 . Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that finction. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highighted below. In all cases, unless othenvise directed, use the earhest appearance of the data in your formulas, usually the Given Data section. b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flows for 2018 . Knapp Inc. Common-sized Income Statement for 2018: 60 Knapp Inc. Common-sized Balance Sheet for 2018: Knapp Inc. Common-sized Balance Sheet for 2018: Assets Cash Accounts Receivable Inventory Current assets Plant and equipment Accumulated depreciation Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable - current (9%) Current liabilities Bonds Owners' equity Common stock Retained earnings Total owners' equity Total liabilities and owners' equity Knapp Inc. Statement of Cash Flows for 2018: Cash Flow from Operating Activities Net Income' Depreciation expense' Decrease in accounts receivable Increase in inventory Decrease in account payable Net cash provided by operating activities Cash Flow from Investing Activities Increase in plant and equipment Cash Flow from Financing Activities Increase in notes payable Dividends Net cash provided by financing activities 95 Net decrease in cash 96 Beginning cash, January 1, 2018 Ending cash, December 31, 2018 Requirements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts