Question: Given the information in the table below, calculate the expected return and standard tion for asset A The expected return for asset B is 11%,

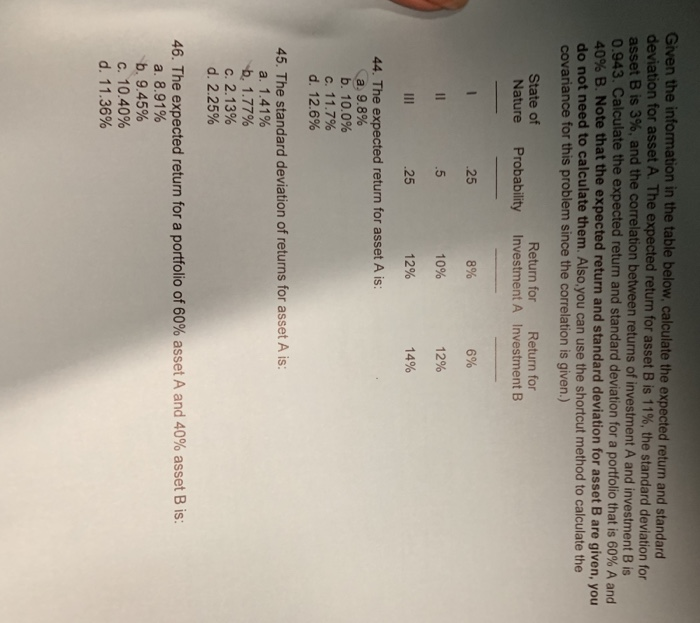

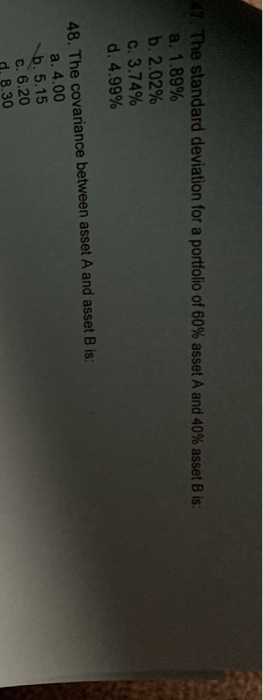

Given the information in the table below, calculate the expected return and standard tion for asset A The expected return for asset B is 11%, the standard deviation for asset B is 3%, and the correlation between returns of investment A and investment B is 0.943. Calculate the expected return and standard deviation for a portfolio that is 60% A and 40% B. Note that the expected return and standard deviation for asset B are given, you do not need to calculate them. Also.you can use the shortcut method to calculate the covariance for this problem since the correlation is given.) State of Return for Return for Nature Probability Investment A Investment B 25 5 .25 44. The expected return for asset A is 8% 10% 12% 6% 12% 14% _a. 9.8% b. 10.0% d. 12.6% 45. The standard deviation of returns for asset A is: a. 1.41% b, 1.77% c. 2.13% d. 2.25% 2 46. The expected return for a portfolio of 60% asset A and 40% asset B is: a. 8.91% b. 9.45% c. 10.40% d. 11.36% 47. The standard deviation for a portfolio of 60% asset A and 40% asset B is: a. 1.89% b. 2.02% . 3.74% d. 4.99% 48. The covariance between asset A and asset B is: a. 4.00 b. 5.15 C. 6.20 d. 8.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts