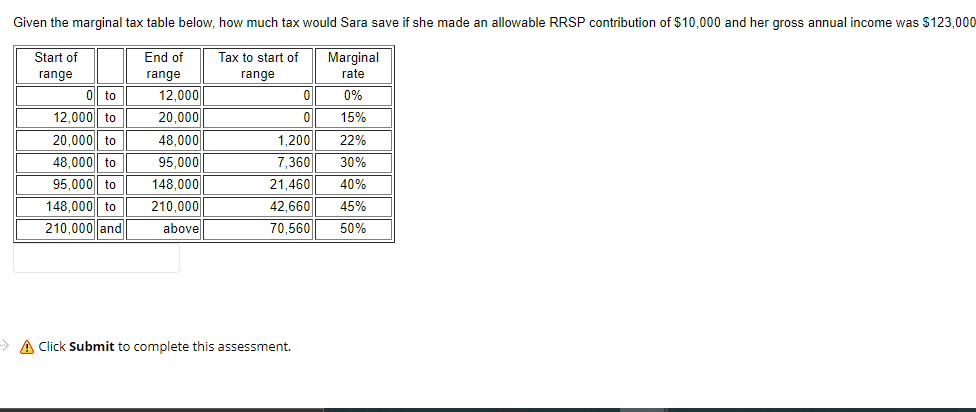

Question: Given the marginal tax table below, how much tax would Sara save if she made an allowable RRSP contribution of $10,000 and her gross annual

Given the marginal tax table below, how much tax would Sara save if she made an allowable RRSP contribution of $10,000 and her gross annual income was $123,000 Start of range Tax to start of range 0 oll to 0 12,000 to 20,000 to 48,000 to 95,000 to 148,000 to 210,000 and End of range 12,000 20,000 48,000 95,000 148,000 210,000 abovel 1,200 7,360 21,460 42,660 70,560 Marginal rate 0% 15% 22% 30% 40% 45% 50% > A Click Submit to complete this assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts