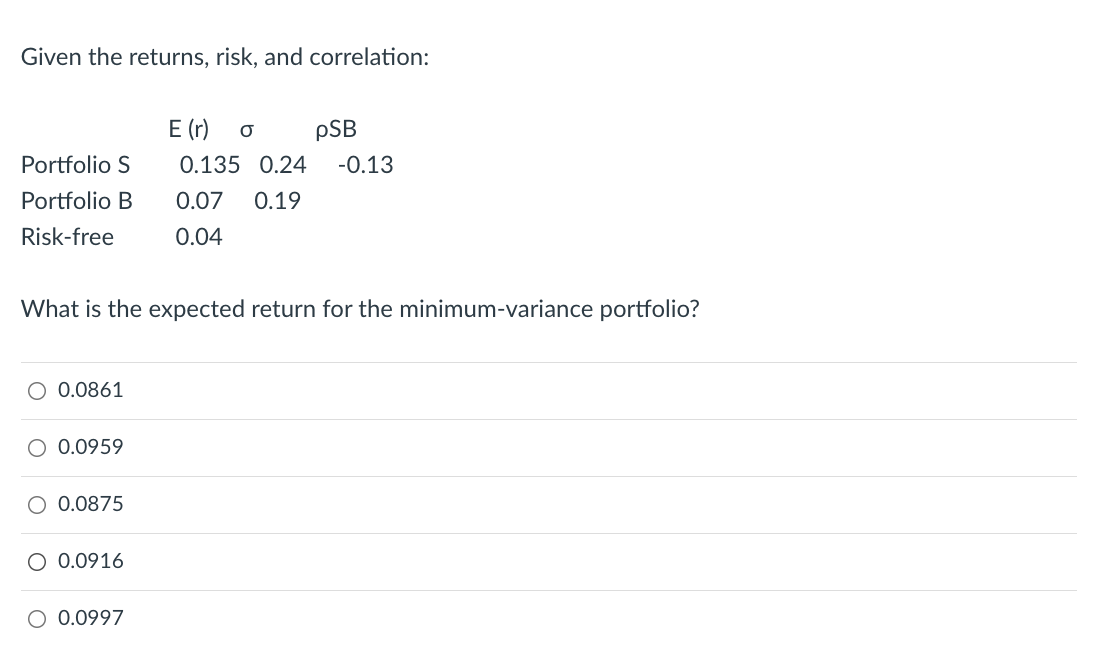

Question: Given the returns, risk, and correlation: E (r) O pSB Portfolio S 0.135 0.24 -0.13 Portfolio B 0.07 0.19 Risk-free 0.04 What is the expected

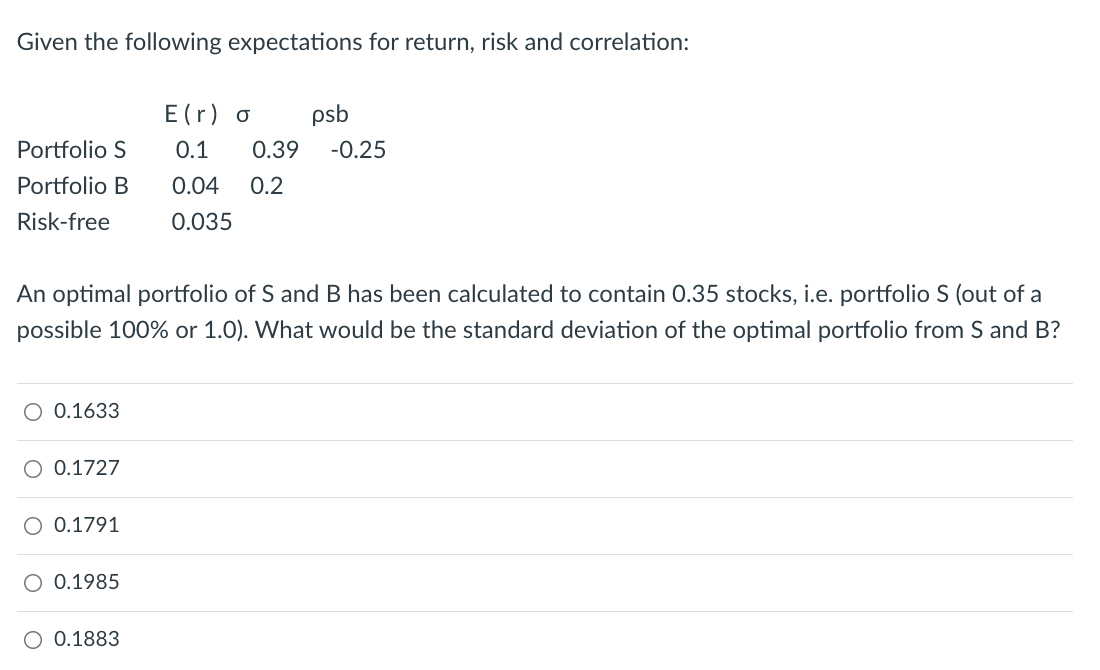

Given the returns, risk, and correlation: E (r) O pSB Portfolio S 0.135 0.24 -0.13 Portfolio B 0.07 0.19 Risk-free 0.04 What is the expected return for the minimum-variance portfolio? O 0.0861 O 0.0959 O 0.0875 O 0.0916 O 0.0997 Given the following expectations for return, risk and correlation: E (r) o psb Portfolio S 0.1 0.39 -0.25 Portfolio B 0.04 0.2 Risk-free 0.035 An optimal portfolio of S and B has been calculated to contain 0.35 stocks, i.e. portfolio S (out of a possible 100% or 1.0). What would be the standard deviation of the optimal portfolio from S and B? O 0.1633 O 0.1727 0.1791 O 0.1985 O 0.1883

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts