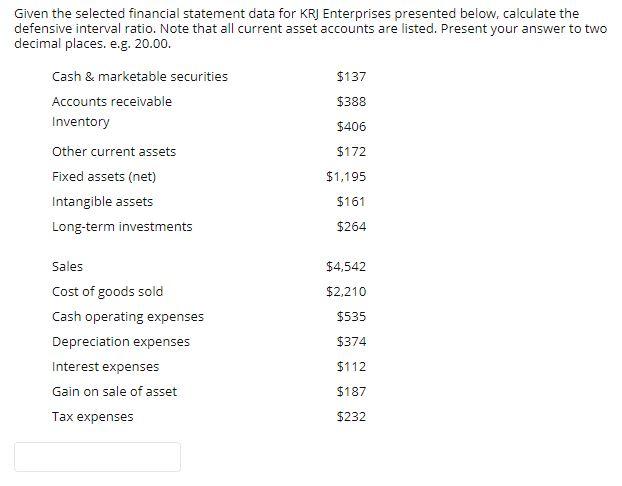

Question: Given the selected financial statement data for KRJ Enterprises presented below, calculate the defensive interval ratio. Note that all current asset accounts are listed. Present

Given the selected financial statement data for KRJ Enterprises presented below, calculate the defensive interval ratio. Note that all current asset accounts are listed. Present your answer to two decimal places. e.g. 20.00. Cash & marketable securities $137 Accounts receivable $388 Inventory $406 Other current assets $172 Fixed assets (net) $1,195 Intangible assets Long-term investments $264 $161 $4,542 $2,210 $535 Sales Cost of goods sold Cash operating expenses Depreciation expenses Interest expenses Gain on sale of asset Tax expenses $374 $112 $187 $232

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts