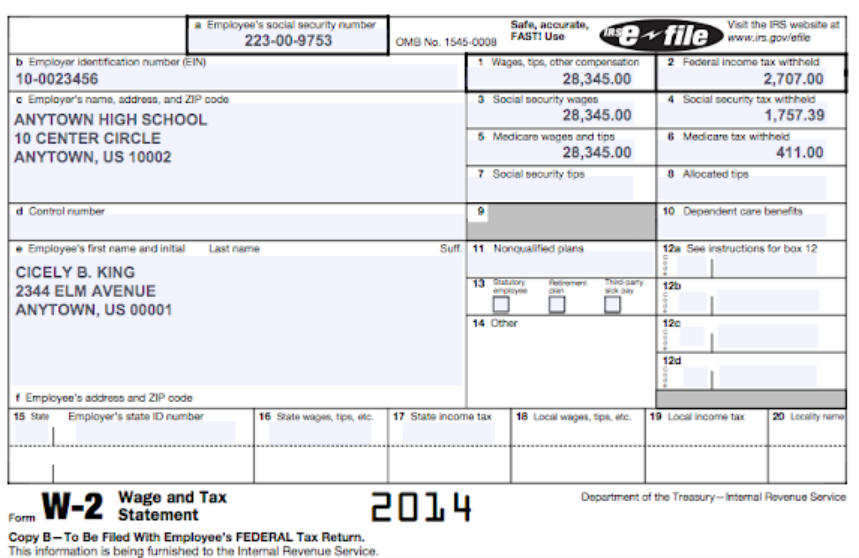

Question: Given this W-2 form, what is the amount this individual has paid? The options are ($2,707 , $28,345 , or $1,757.39) Employee's social security number

Given this W-2 form, what is the amount this individual has paid?

The options are ($2,707 , $28,345 , or $1,757.39)

Employee's social security number 223-00-9753 b Employer identification number (EIN) 10-0023456 Employer's name, address, and ZIP code ANYTOWN HIGH SCHOOL 10 CENTER CIRCLE ANYTOWN, US 10002 Safe, accurate, Vsa the IRS website at OMB No 1545-0009 FAST! Use ne- file www.is.govletile 1 Wages, tips, other compensation 2 Federal income tax withhold 28,345.00 2,707.00 3 Social ocurity wagen 4 Social security tax withhold 28,345.00 1,757.39 5 Modicaro wagos and tips 6 Medicare tax withhold 28,345.00 411.00 7 Social security tips 8 Alocated tips Control number 10 Dependent care benefits SUT 11 Nonqualified plans 12 See instructions for box 12 Employee's first name and initial Last name CICELY B. KING 2344 ELM AVENUE ANYTOWN, US 00001 125 14 Other 120 120 Employee's address and ZIP code 15 State Employer's state ID number 16 Szato wages, tips, etc. 17 State income tax 18 Local wages, pk, etc 19 Local income tax 20 locally reme Department of the Treasury-Internal Revenue Service W-2 Wage and Tax 2014 Form Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts