Question: GL0403 (Algo) - Based on Problem 4-5A LO A1, P3, P4 The fiscal year-end unadjusted trial balance for Lewis Company is found on the trial

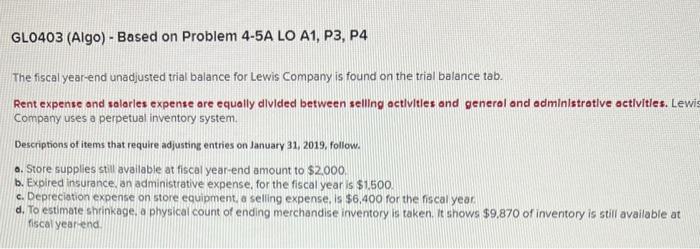

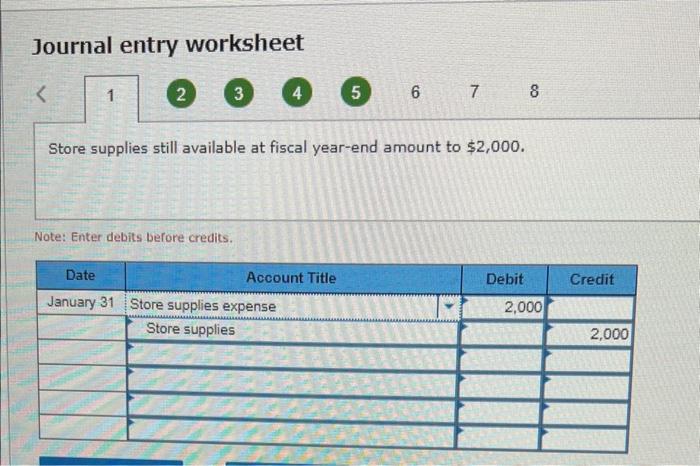

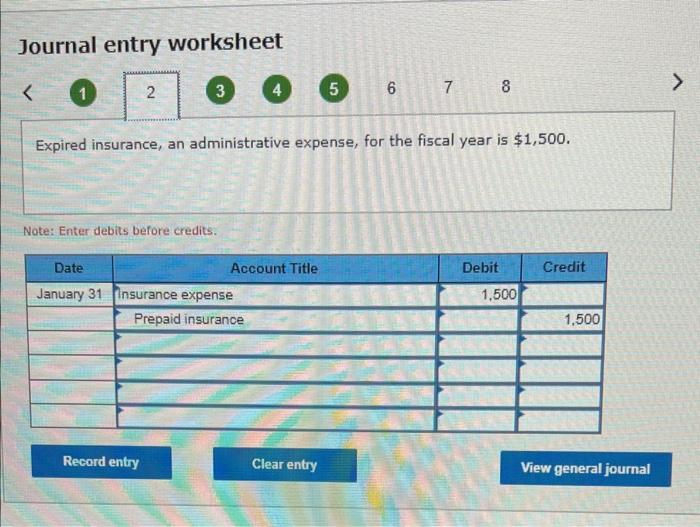

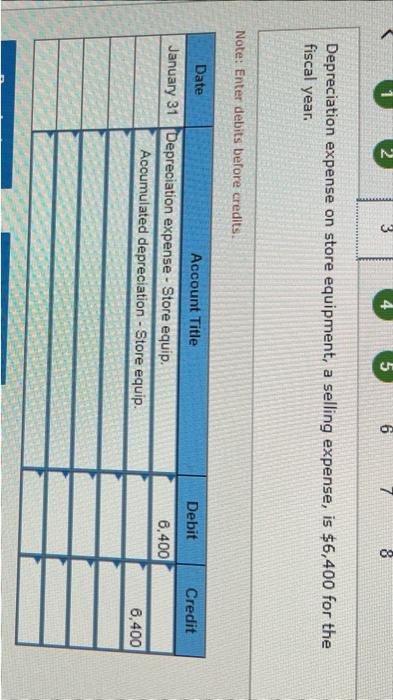

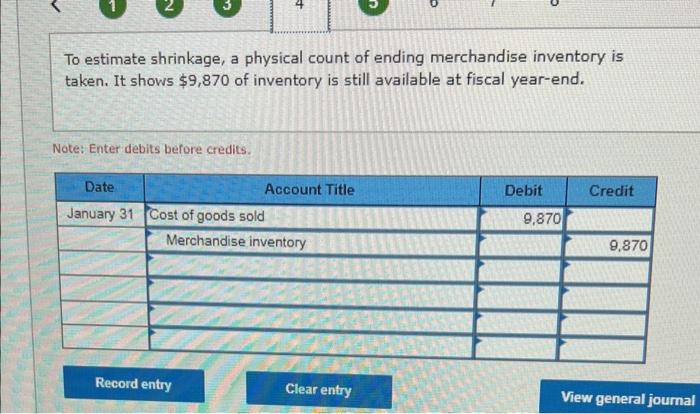

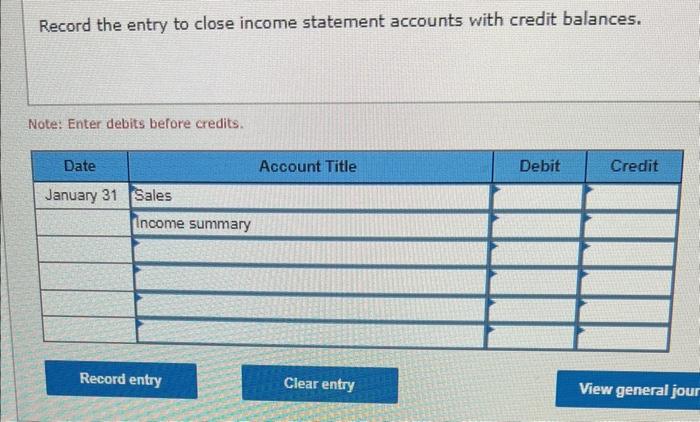

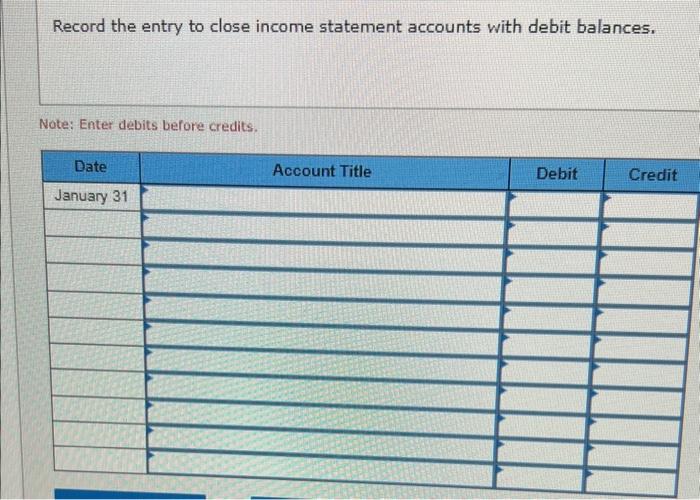

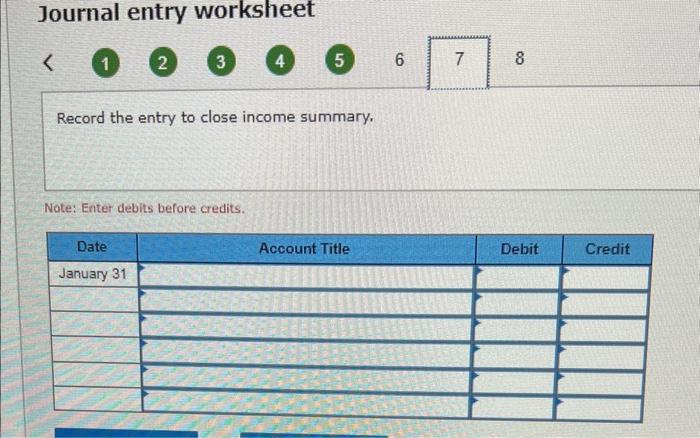

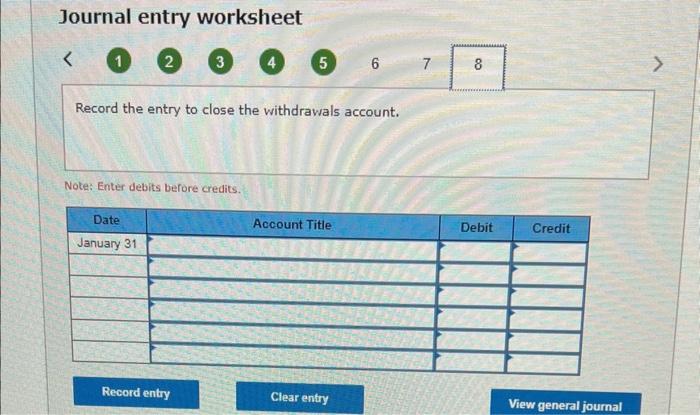

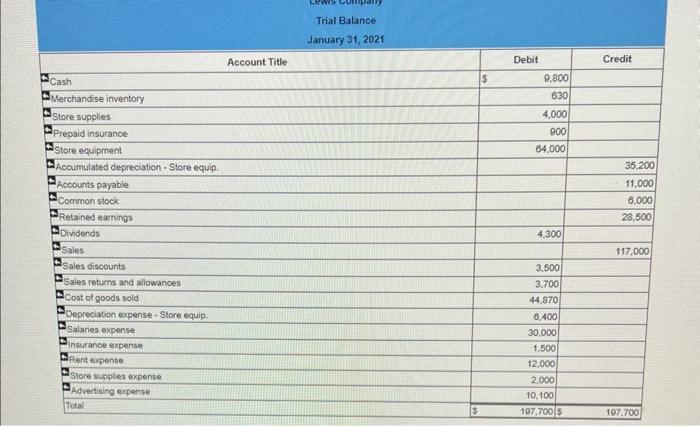

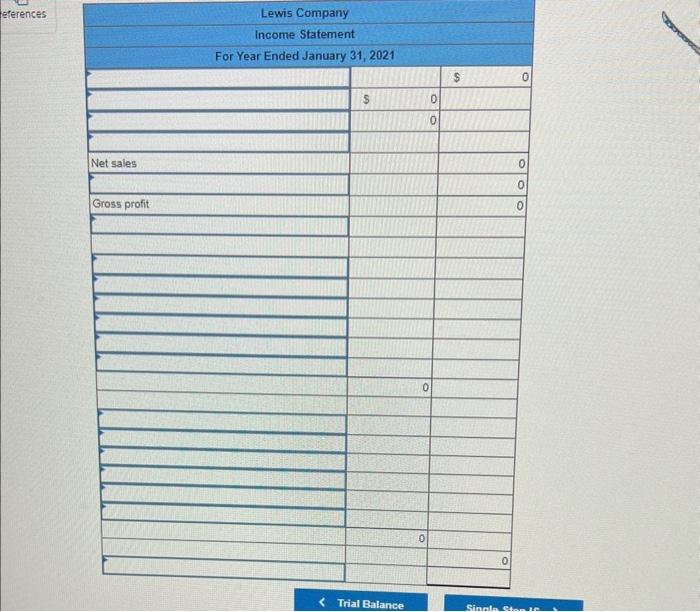

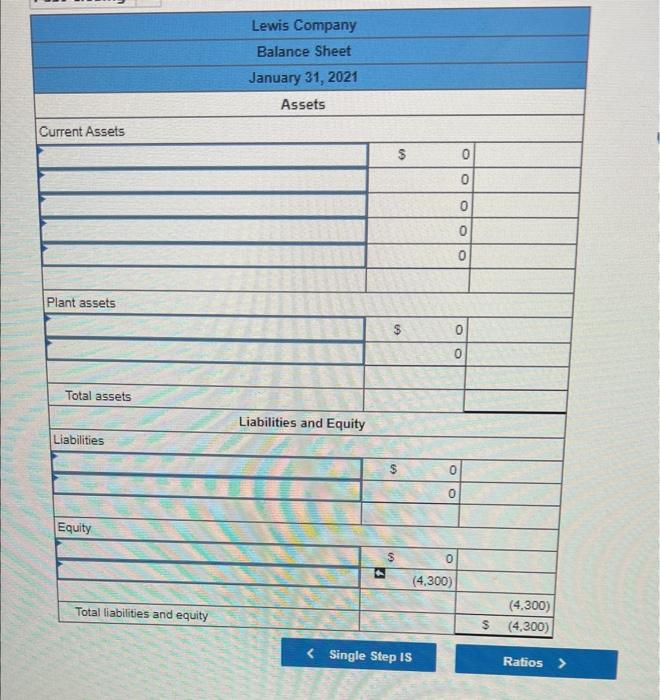

GL0403 (Algo) - Based on Problem 4-5A LO A1, P3, P4 The fiscal year-end unadjusted trial balance for Lewis Company is found on the trial balance tab. Rent expense and salaries expense are equally dlvided between selling actlvities and general and adminlstrative actlvities. Lewi Company uses a perpetual inventory system. Descriptions of items that require adjusting entries on January 31, 2019, follow. a. Store supplies still available at fiscal year-end amount to $2000. b. Expired insurance, an administrative expense, for the fiscal year is $1,500. c. Depreciation expense on store equipment, a selling expense. is $6,400 for the fiscal year: d. To estimate shinkage. a physical count of ending merchandise inventory is taken. It shows $9.870 of inventory is still available at fiscalyearend. Journal entry worksheet 3 45 7 8 Store supplies still available at fiscal year-end amount to $2,000. Note: Enter debits before credits. Journal entry worksheet Expired insurance, an administrative expense, for the fiscal year is $1,500. Note: Enter debits before credits. Depreciation expense on store equipment, a selling expense, is $6,400 for the fiscal year. Note: Enter debits before credits. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $9,870 of inventory is still available at fiscal year-end. Note: Enter debits before credits. Record the entry to close income statement accounts with credit balances. Note: Enter debits before credits. Record the entry to close income statement accounts with debit balances. Note: Enter debits before credits. Journal entry worksheet 1 2 3 4 5 Record the entry to close income summary. Note: Enter debits before credits. Journal entry worksheet 1 2 3 4 (5) 6 Record the entry to close the withdrawals account. Note: Enter debits before credits. Trial Balance January 31,2021 \begin{tabular}{|l|} \hline Current ratio \\ \hline Acid-test ratio \\ \hline Gross margin ratio \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts