Question: Global Corp. initially projected the 2016 income statement shown in the table B. Suppose that in 2016, Global launched an aggressive marketing campaign that boosted

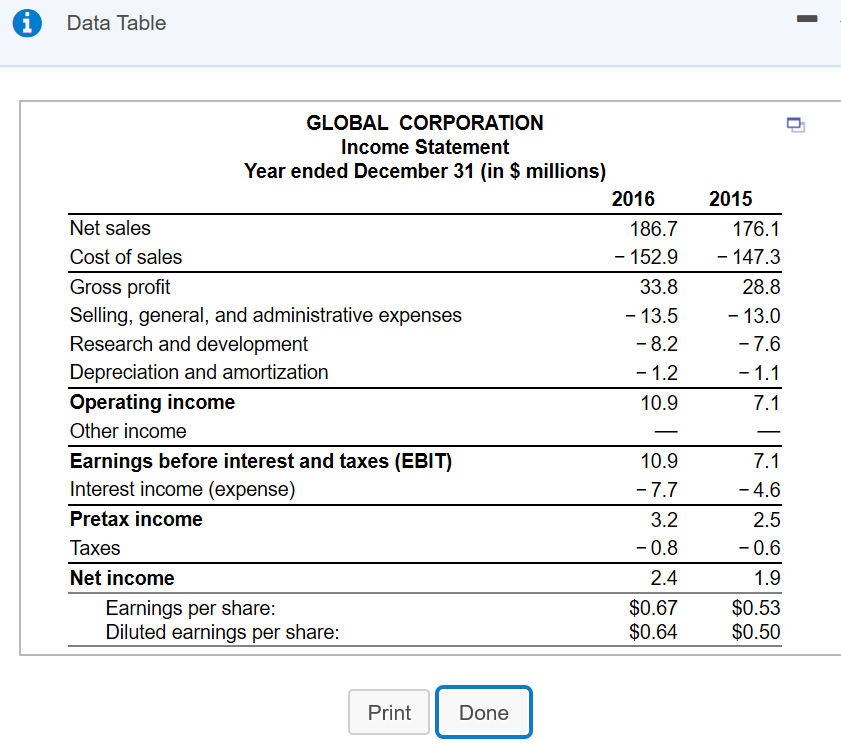

Global Corp. initially projected the 2016 income statement shown in the table B. Suppose that in 2016, Global launched an aggressive marketing campaign that boosted 2016 sales further by 15.7%. However, their operating margin fell from 5.83% to 4.14% Suppose that they had no other income, interest expenses were unchanged, and taxes were the same percentage of pretax income (26%) as in 2015. a. What was Global's EBIT in 2016? b. What was Global's income in 2016? c. If Global's P/E ratio (18.0) and number of shares outstanding (3.6 million) remained unchanged, what was Global share price in 2016? a. What was Global's EBIT in 2016? Global's EBIT was $million. (Round to two decimal places.) b. What was Global's income in 2016? Net income was $ million. (Round to two decimal places.) c. If Global's P/E ratio (18.0) and number of shares outstanding (3.6 million) remained unchanged, what was Global' share price in 22016? Global's share price in 2016 was (Round to the nearest cent.) i Data Table GLOBAL CORPORATION Income Statement Year ended December 31 (in $ millions) 2016 Net sales 186.7 Cost of sales - 152.9 Gross profit 33.8 Selling, general, and administrative expenses - 13.5 Research and development -8.2 Depreciation and amortization - 1.2 Operating income 10.9 Other income Earnings before interest and taxes (EBIT) 10.9 Interest income (expense) -7.7 Pretax income 3.2 Taxes -0.8 Net income 2.4 Earnings per share: $0.67 Diluted earnings per share: $0.64 2015 176.1 - 147.3 28.8 - 13.0 - 7.6 - 1.1 7.1 7.1 -4.6 2.5 -0.6 1.9 $0.53 $0.50 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts