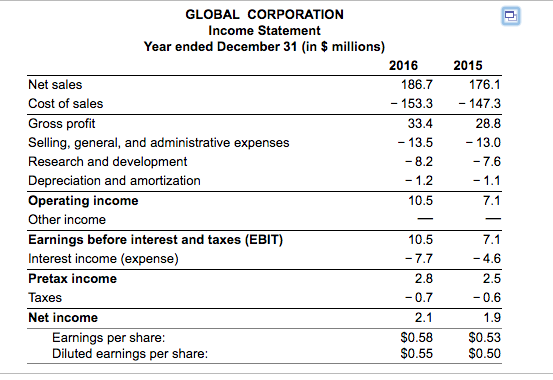

Question: Global Corp. initially projected the 2016 income statement shown in the table Suppose that in 2016, Global launched an aggressive marketing campaign that boosted 2016

Global Corp. initially projected the 2016 income statement shown in the table

Suppose that in 2016, Global launched an aggressive marketing campaign that boosted 2016 sales further by 14.8 %.

However, their operating margin fell from 5.62 % to 3.86 % Suppose that they had no other income, interest expenses wereunchanged, and taxes were the same percentage of pretax income (26 %) as in 2015

a. What was Global's EBIT in 2016?

b. What was Global's income in 2016?

c. If Global's P/E ratio (18.0) and number of shares outstanding (3.6 million) remained unchanged, what was Global's share price in 2016?

GLOBAL CORPORATION Income Statement Year ended December 31 (in $ millions) 2016 2015 176.1 - 153.3147.3 28.8 -13.0 Net sales Cost of sales Gross profit Selling, general, and administrative expenses Research and development Depreciation and amortization Operating income Other income Earnings before interest and taxes (EBIT) Interest income (expense) Pretax income Taxes Net income 186.7 33.4 - 13.5 10.5 10.5 2.8 2.5 Earnings per share Diluted earnings per share 2.1 S0.58 S0.55 1.9 $0.53 S0.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts