Question: Global developed the pro forma financial statements given below. Assume that Global Corp. expects sales to grow by 11% next year, pays out 60% of

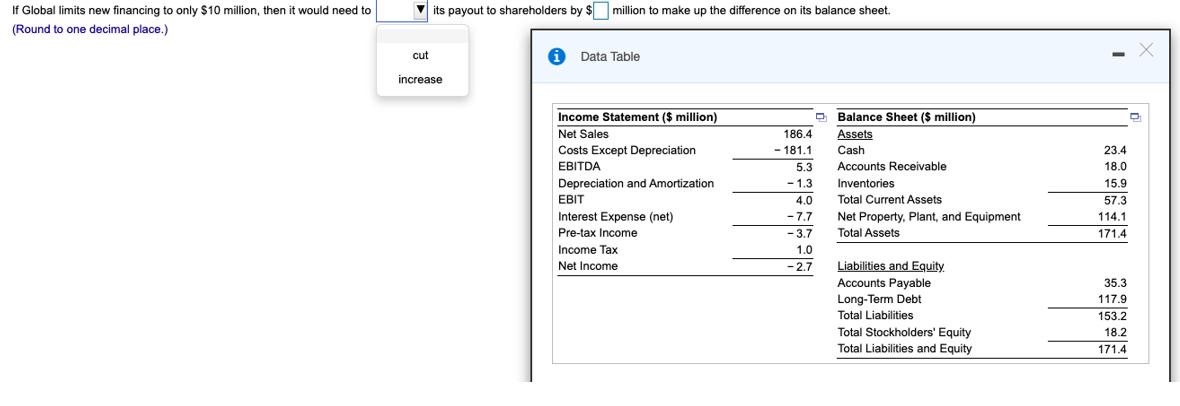

Global developed the pro forma financial statements given below. Assume that Global Corp. expects sales to grow by 11% next year, pays out 60% of its net income, and needs $10.2 million of net new financing. If Global decides that it will limit its net new financing to no more than $10 million, how will this affect its payout policy?

If Global limits new financing to only $10 million, then it would need to (Round to one decimal place.) cut its payout to shareholders by $ million to make up the difference on its balance sheet. increase Data Table Income Statement ($ million) Net Sales Costs Except Depreciation EBITDA Depreciation and Amortization EBIT Interest Expense (net) Pre-tax Income Income Tax Net Income 186.4 -181.1 5.3 -1.3 4.0 -7.7 -3.7 1.0 -2.7 Balance Sheet ($ million) Assets Cash Accounts Receivable Inventories Total Current Assets Net Property, Plant, and Equipment Total Assets Liabilities and Equity. Accounts Payable Long-Term Debt Total Liabilities Total Stockholders Equity Total Liabilities and Equity - 23.4 18.0 15.9 57.3 114.1 171.4 35.3 117.9 153.2 18.2 171.4 X

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

In this If Glbl limits new finn... View full answer

Get step-by-step solutions from verified subject matter experts