Question

Globally, Haagen Dazs is the leader with approximately 41.7% market share of the super-premium ice cream market that grew at double-digit rates through the

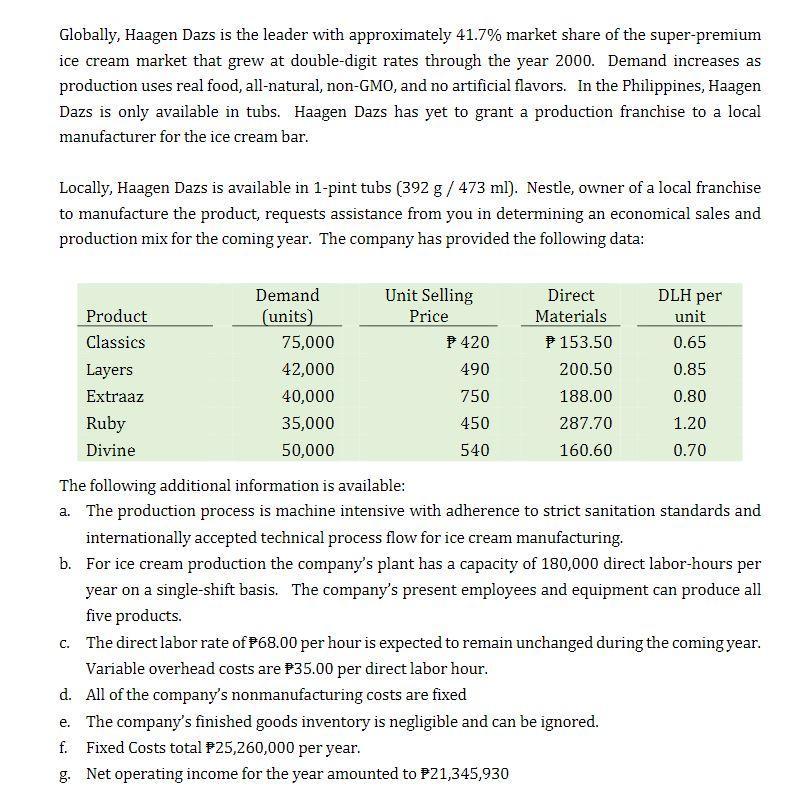

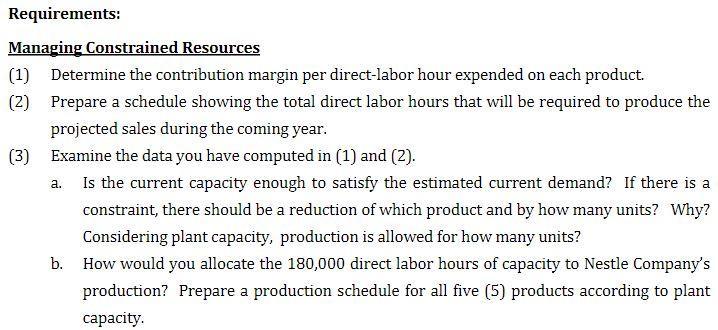

Globally, Haagen Dazs is the leader with approximately 41.7% market share of the super-premium ice cream market that grew at double-digit rates through the year 2000. Demand increases as production uses real food, all-natural, non-GMO, and no artificial flavors. In the Philippines, Haagen Dazs is only available in tubs. Haagen Dazs has yet to grant a production franchise to a local manufacturer for the ice cream bar. Locally, Haagen Dazs is available in 1-pint tubs (392 g / 473 ml). Nestle, owner of a local franchise to manufacture the product, requests assistance from you in determining an economical sales and production mix for the coming year. The company has provided the following data: Product Classics Layers Extraaz Ruby Divine Demand (units) 75,000 42,000 40,000 35,000 50,000 Unit Selling Price P 420 490 750 450 540 Direct Materials P 153.50 200.50 188.00 287.70 160.60 DLH per unit 0.65 0.85 0.80 1.20 0.70 The following additional information is available: a. The production process is machine intensive with adherence to strict sanitation standards and internationally accepted technical process flow for ice cream manufacturing. b. For ice cream production the company's plant has a capacity of 180,000 direct labor-hours per year on a single-shift basis. The company's present employees and equipment can produce all five products. e. The company's finished goods inventory is negligible and can be ignored. f. Fixed Costs total #25,260,000 per year. g. Net operating income for the year amounted to $21,345,930 c. The direct labor rate of $68.00 per hour is expected to remain unchanged during the coming year. Variable overhead costs are $35.00 per direct labor hour. d. All of the company's nonmanufacturing costs are fixed Requirements: Managing Constrained Resources (1) Determine the contribution margin per direct-labor hour expended on each product. Prepare a schedule showing the total direct labor hours that will be required to produce the projected sales during the coming year. (2) Examine the data you have computed in (1) and (2). Is the current capacity enough to satisfy the estimated current demand? If there is a constraint, there should be a reduction of which product and by how many units? Why? Considering plant capacity, production is allowed for how many units? b. How would you allocate the 180,000 direct labor hours of capacity to Nestle Company's production? Prepare a production schedule for all five (5) products according to plant capacity. (3) a.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 similarly The variable overhead per unit Direct labor hour ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started