Question: gnment 0 Help Save& Exit Submit On August 31, 2019, the balance in the checkbook and the Cash account of the Dry Creek Bed and

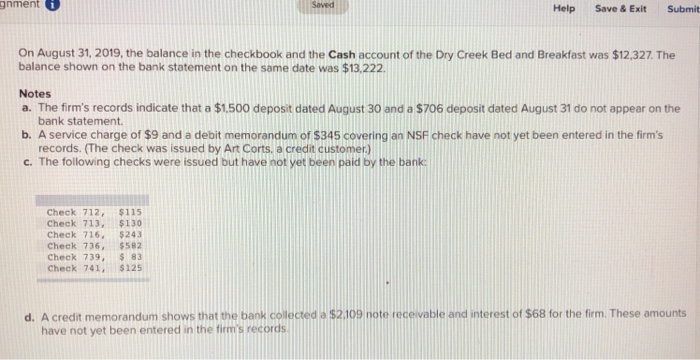

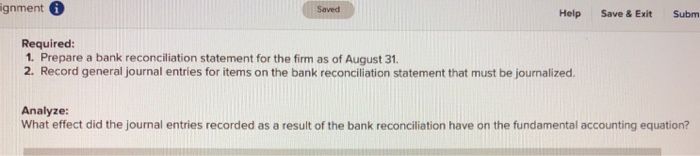

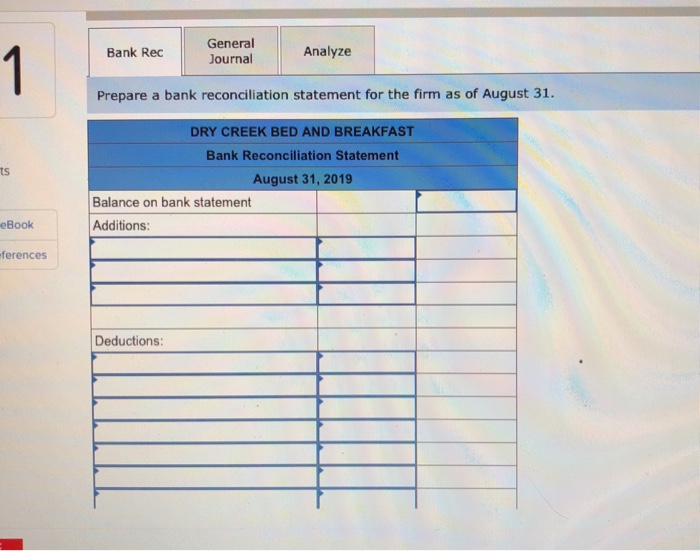

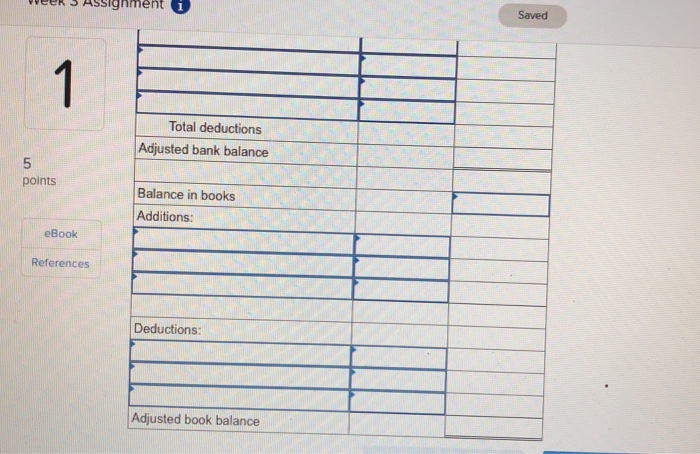

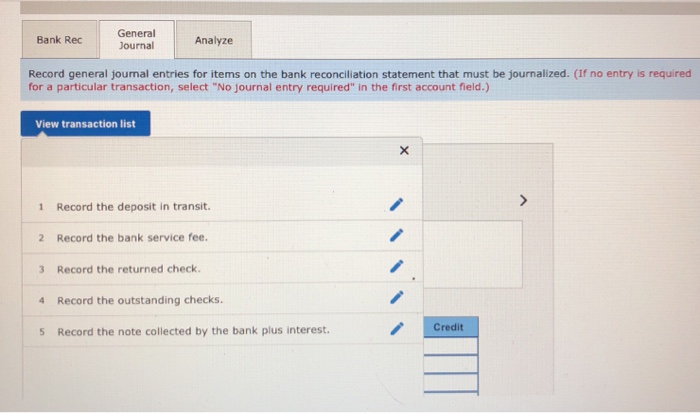

gnment 0 Help Save& Exit Submit On August 31, 2019, the balance in the checkbook and the Cash account of the Dry Creek Bed and Breakfast was $12,327. The balance shown on the bank statement on the same date was $13,222 Notes a. The firm's records indicate that a $1,500 deposit dated August 30 and a $706 deposit dated August 31 do not appear on the bank statement b. A service charge of $9 and a debit memorandum of $345 covering an NSF check have not yet been entered in the firm's records. (The check was issued by Art Corts. a credit customer.) c. The following checks were issued but have not yet been paid by the bank Check 712, $115 Check 713, $130 Check 716, $243 Check 736, $582 Check 739, $ 83 Check 741 $125 d. A credit memorandum shows that the bank collected a $2109 note recevable and interest of $68 for the firm. These amounts have not yet been entered in the firm's records

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts