Question: # Going long c. what is her expected cost? d.if her Dec. 2023 corn future rise to $5.00, what is her expected net cost? e.

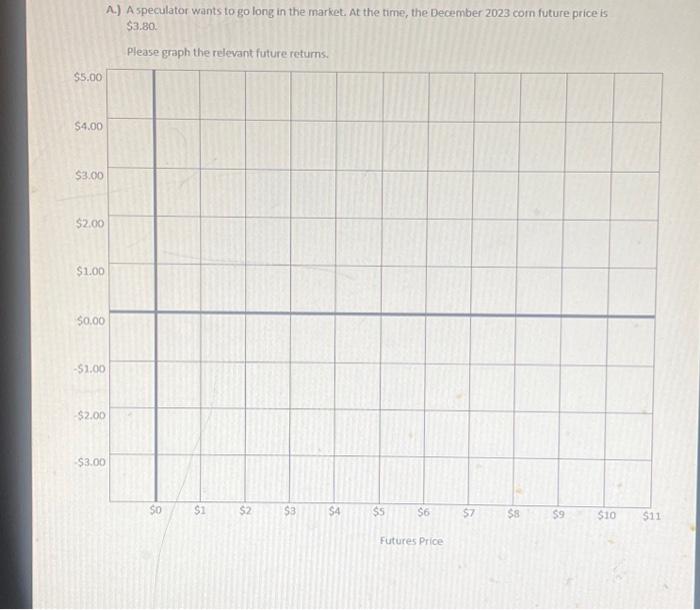

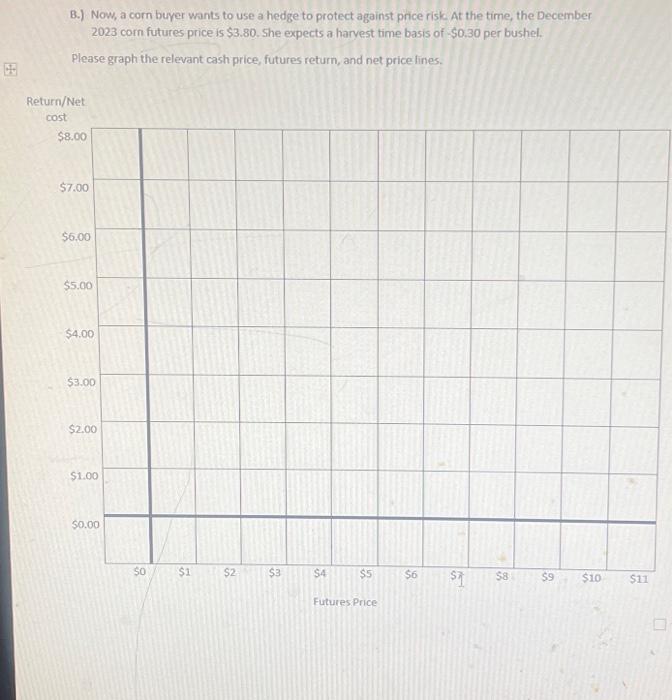

A.) A speculator wants to go long in the market. At the time, the December 2023 com future price is $3.80. B.) Now, a corn buyer wants to use a hedge to protect against price risk At the time, the December 2023 corn futures price is $3.80. She expects a haryest time basis of $0.30 per bushel. Please graph the relevant cash price, futures return, and net price lines. A.) A speculator wants to go long in the market. At the time, the December 2023 com future price is $3.80. B.) Now, a corn buyer wants to use a hedge to protect against price risk At the time, the December 2023 corn futures price is $3.80. She expects a haryest time basis of $0.30 per bushel. Please graph the relevant cash price, futures return, and net price lines

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts