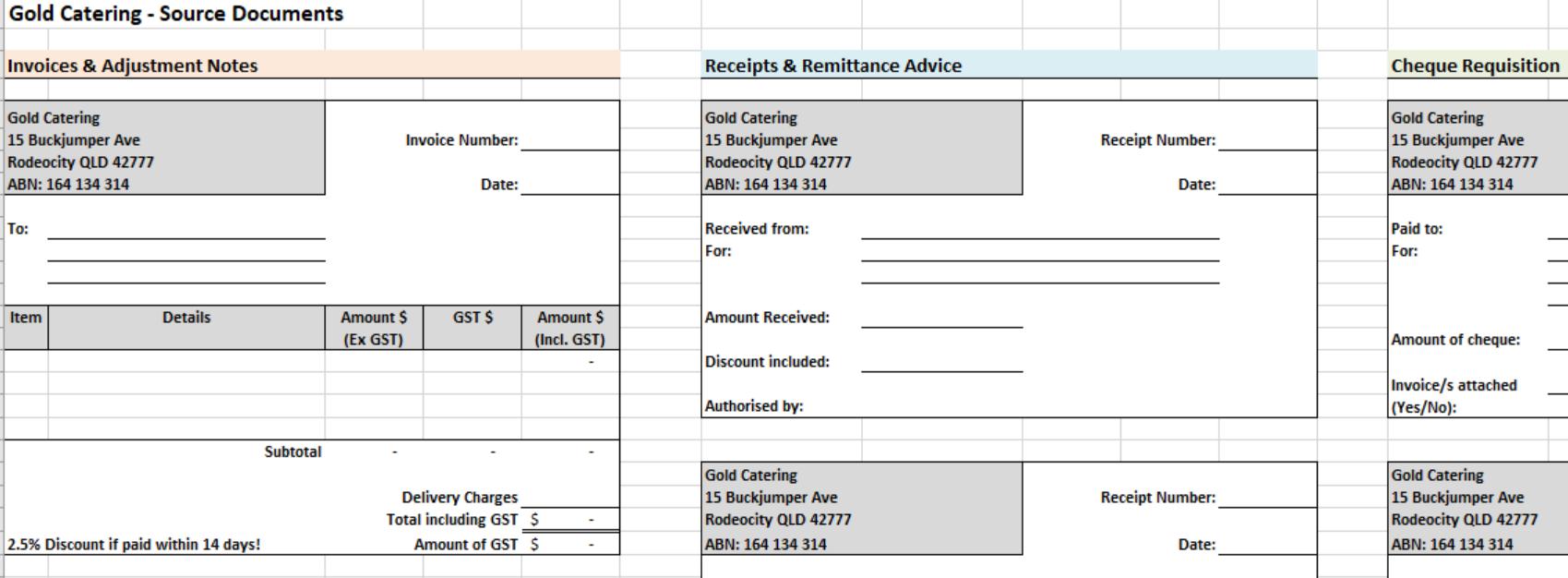

Question: Gold Catering - Source Documents Invoices & Adjustment Notes Gold Catering 15 Buckjumper Ave Rodeocity QLD 42777 ABN: 164 134 314 To: Invoice Number:

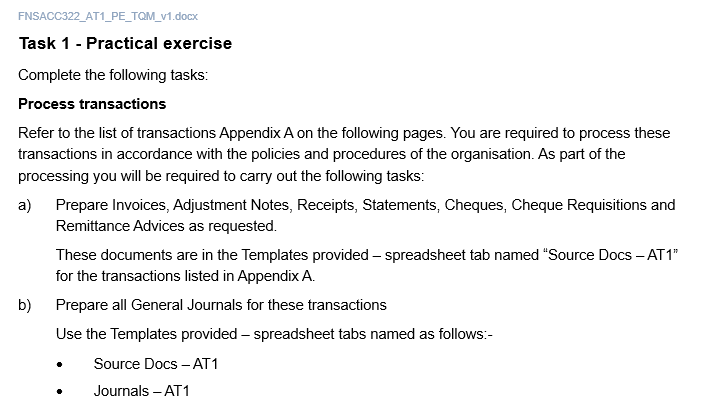

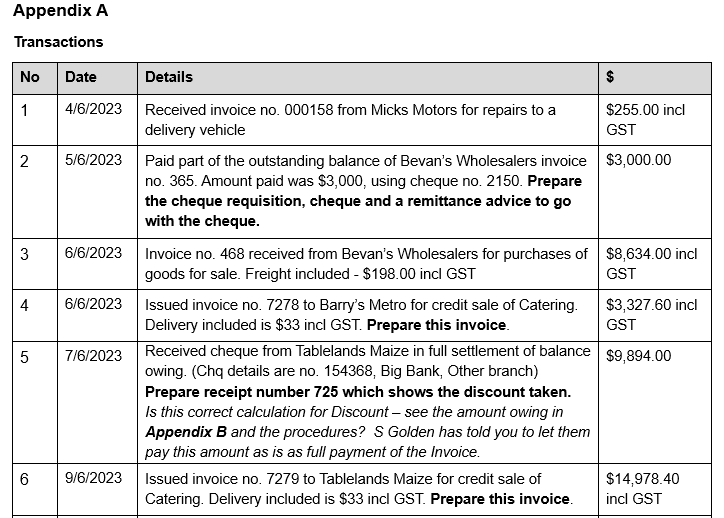

Gold Catering - Source Documents Invoices & Adjustment Notes Gold Catering 15 Buckjumper Ave Rodeocity QLD 42777 ABN: 164 134 314 To: Invoice Number: Date: Receipts & Remittance Advice Gold Catering 15 Buckjumper Ave Rodeocity QLD 42777 ABN: 164 134 314 Received from: For: Item Details Amount $ (Ex GST) GST $ Amount $ (Incl. GST) Amount Received: Discount included: 2.5% Discount if paid within 14 days! Subtotal Authorised by: Delivery Charges Total including GST $ Amount of GST $ Gold Catering 15 Buckjumper Ave Rodeocity QLD 42777 ABN: 164 134 314 Receipt Number: Date: Receipt Number: Date: Cheque Requisition Gold Catering 15 Buckjumper Ave Rodeocity QLD 42777 ABN: 164 134 314 Paid to: For: Amount of cheque: Invoice/s attached (Yes/No): Gold Catering 15 Buckjumper Ave Rodeocity QLD 42777 ABN: 164 134 314 FNSACC322_AT1_PE_TQM_v1.docx Task 1 - Practical exercise Complete the following tasks: Process transactions Refer to the list of transactions Appendix A on the following pages. You are required to process these transactions in accordance with the policies and procedures of the organisation. As part of the processing you will be required to carry out the following tasks: a) Prepare Invoices, Adjustment Notes, Receipts, Statements, Cheques, Cheque Requisitions and Remittance Advices as requested. These documents are in the Templates provided - spreadsheet tab named "Source Docs - AT1" for the transactions listed in Appendix A. b) Prepare all General Journals for these transactions Use the Templates provided - spreadsheet tabs named as follows:- Source Docs - AT1 Journals - AT1 Appendix A Transactions No Date Details 1 4/6/2023 Received invoice no. 000158 from Micks Motors for repairs to a delivery vehicle $255.00 incl GST 2 5/6/2023 3 Paid part of the outstanding balance of Bevan's Wholesalers invoice $3,000.00 no. 365. Amount paid was $3,000, using cheque no. 2150. Prepare the cheque requisition, cheque and a remittance advice to go with the cheque. 6/6/2023 Invoice no. 468 received from Bevan's Wholesalers for purchases of $8,634.00 incl goods for sale. Freight included - $198.00 incl GST GST 4 6/6/2023 Issued invoice no. 7278 to Barry's Metro for credit sale of Catering. Delivery included is $33 incl GST. Prepare this invoice. $3,327.60 incl GST 5 7/6/2023 6 9/6/2023 Received cheque from Tablelands Maize in full settlement of balance $9,894.00 owing. (Chq details are no. 154368, Big Bank, Other branch) Prepare receipt number 725 which shows the discount taken. Is this correct calculation for Discount - see the amount owing in Appendix B and the procedures? S Golden has told you to let them pay this amount as is as full payment of the Invoice. Issued invoice no. 7279 to Tablelands Maize for credit sale of Catering. Delivery included is $33 incl GST. Prepare this invoice. $14,978.40 incl GST

Step by Step Solution

There are 3 Steps involved in it

Here are the documents and general journals prepared for the transactions ... View full answer

Get step-by-step solutions from verified subject matter experts