Question: Gomez Electronics needs to arrange financing for its expansion program. Bank A offers to lend Gomez the required funds on a loan with an APR

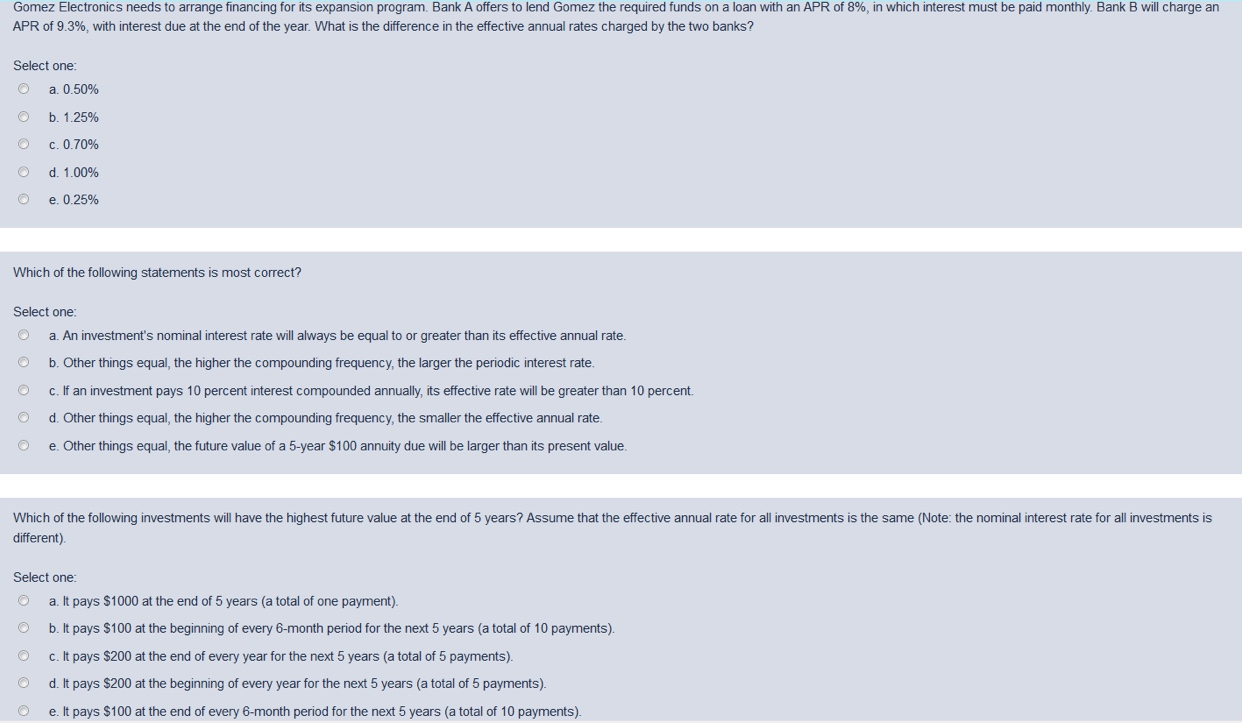

Gomez Electronics needs to arrange financing for its expansion program. Bank A offers to lend Gomez the required funds on a loan with an APR of 8%, in which interest must be paid monthly. Bank B will charge an APR of 9.3%, with interest due at the end of the year. What is the difference in the effective annual rates charged by the two banks? Select one: a. 0.50% b. 1.25% c. 0.70% d. 1.00% e. 0.25% Which of the following statements is most correct? Select one: a. An investment's nominal interest rate will always be equal to or greater than its effective annual rate. b. Other things equal, the higher the compounding frequency, the larger the periodic interest rate. c. If an investment pays 10 percent interest compounded annually, its effective rate will be greater than 10 percent. d. Other things equal, the higher the compounding frequency, the smaller the effective annual rate. e. Other things equal, the future value of a 5-year $100 annuity due will be larger than its present value. Which of the following investments will have the highest future value at the end of 5 years? Assume that the effective annual rate for all investments is the same (Note: the nominal interest rate for all investments is different) Select one: a. It pays $1000 at the end of 5 years (a total of one payment) b. It pays $100 at the beginning of every 6-month period for the next 5 years (a total of 10 payments). c. It pays $200 at the end of every year for the next 5 years (a total of 5 payments). d. It pays $200 at the beginning of every year for the next 5 years (a total of 5 payments). e. It pays $100 at the end of every 6-month period for the next 5 years (a total of 10 payments)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts