Question: Good evening , i need a help on this exersice , can someone help me ? The company Alfa issued an annual bill of 90,000,000

Good evening , i need a help on this exersice , can someone help me ?

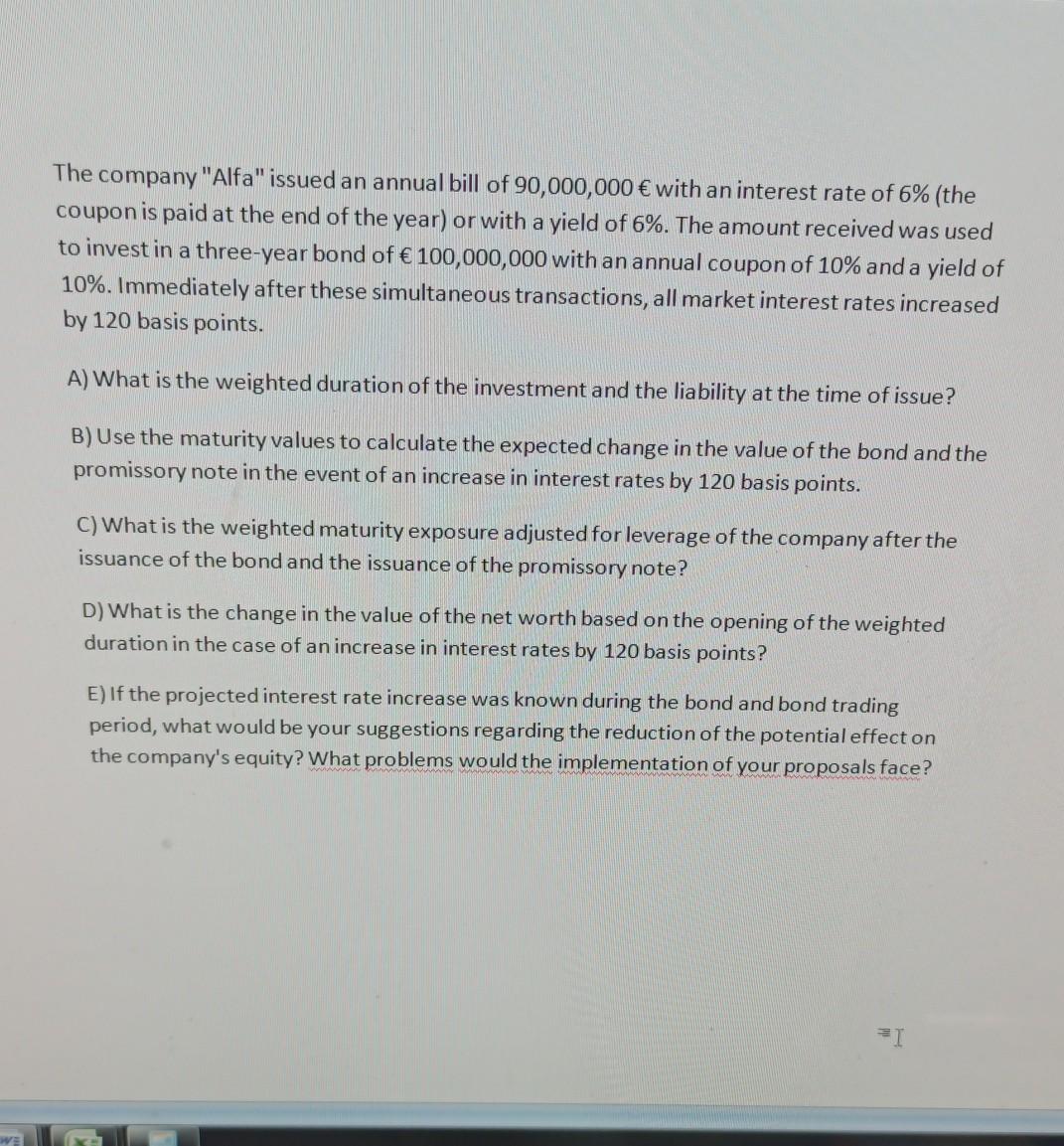

The company "Alfa" issued an annual bill of 90,000,000 with an interest rate of 6% (the coupon is paid at the end of the year) or with a yield of 6%. The amount received was used to invest in a three-year bond of 100,000,000 with an annual coupon of 10% and a yield of 10%. Immediately after these simultaneous transactions, all market interest rates increased by 120 basis points. A) What is the weighted duration of the investment and the liability at the time of issue? B) Use the maturity values to calculate the expected change in the value of the bond and the promissory note in the event of an increase in interest rates by 120 basis points. C) What is the weighted maturity exposure adjusted for leverage of the company after the issuance of the bond and the issuance of the promissory note? D) What is the change in the value of the net worth based on the opening of the weighted duration in the case of an increase in interest rates by 120 basis points? E) If the projected interest rate increase was known during the bond and bond trading period, what would be your suggestions regarding the reduction of the potential effect on the company's equity? What problems would the implementation of your proposals face? T I The company "Alfa" issued an annual bill of 90,000,000 with an interest rate of 6% (the coupon is paid at the end of the year) or with a yield of 6%. The amount received was used to invest in a three-year bond of 100,000,000 with an annual coupon of 10% and a yield of 10%. Immediately after these simultaneous transactions, all market interest rates increased by 120 basis points. A) What is the weighted duration of the investment and the liability at the time of issue? B) Use the maturity values to calculate the expected change in the value of the bond and the promissory note in the event of an increase in interest rates by 120 basis points. C) What is the weighted maturity exposure adjusted for leverage of the company after the issuance of the bond and the issuance of the promissory note? D) What is the change in the value of the net worth based on the opening of the weighted duration in the case of an increase in interest rates by 120 basis points? E) If the projected interest rate increase was known during the bond and bond trading period, what would be your suggestions regarding the reduction of the potential effect on the company's equity? What problems would the implementation of your proposals face? T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts