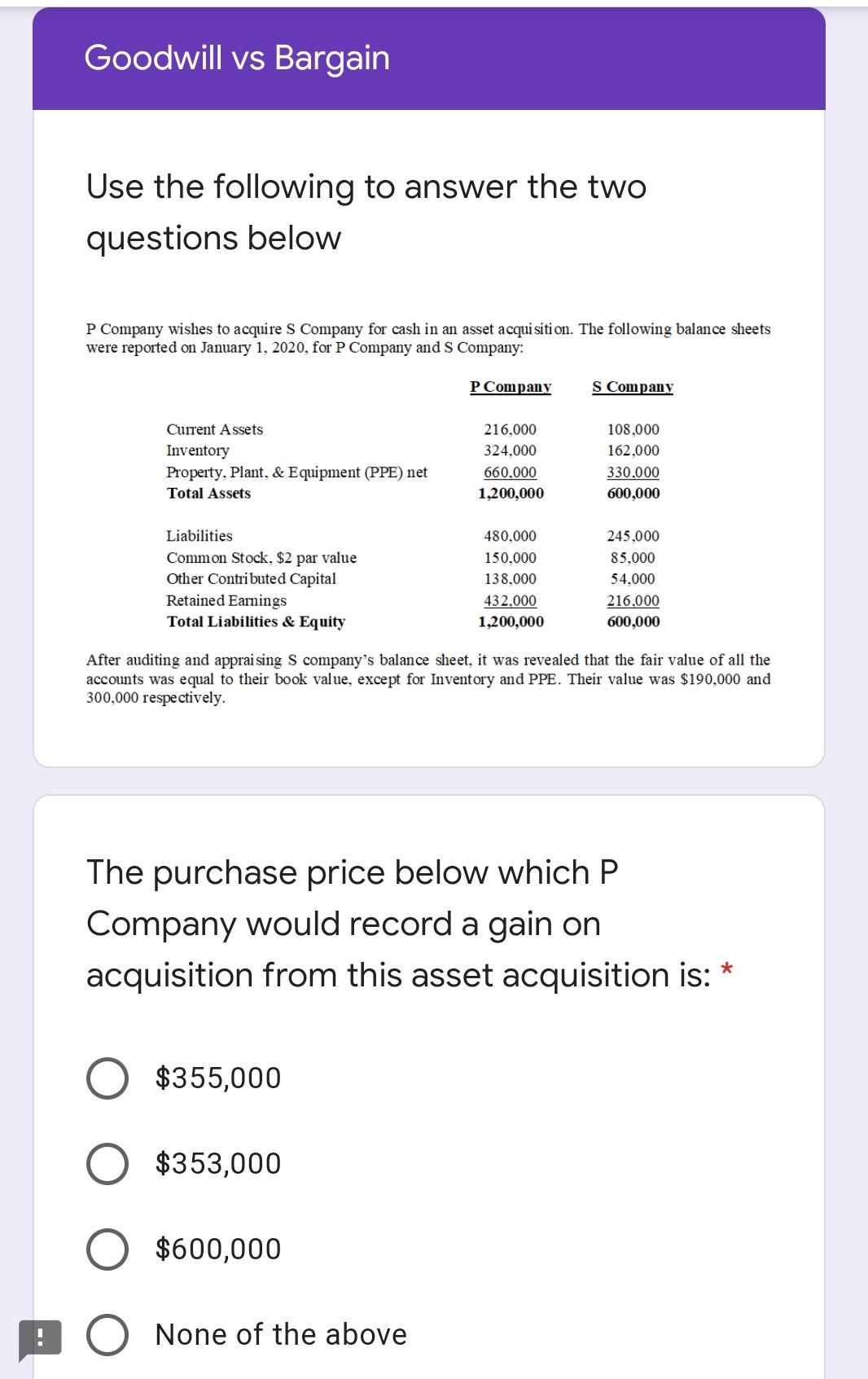

Question: Goodwill vs Bargain Use the following to answer the two questions below P Company wishes to acquire S Company for cash in an asset acquisition.

Goodwill vs Bargain Use the following to answer the two questions below P Company wishes to acquire S Company for cash in an asset acquisition. The following balance sheets were reported on January 1, 2020, for P Company and S Company: P Company S Company Current Assets Inventory Property, Plant, & Equipment (PPE) net Total Assets 216.000 324.000 660.000 1,200,000 108.000 162.000 330.000 600,000 Liabilities Common Stock, $2 par value Other Contributed Capital Retained Earnings Total Liabilities & Equity 480,000 150,000 138,000 432.000 1,200,000 245.000 85.000 54.000 216.000 600,000 After auditing and appraising S company's balance sheet, it was revealed that the fair value of all the accounts was equal to their book value, except for Inventory and PPE. Their value was $190,000 and 300,000 respectively. The purchase price below which P Company would record a gain on acquisition from this asset acquisition is: * $355,000 $353,000 $600,000 O None of the above The purchase price at which P Company would record a $52,000 gain on acquisition is: * $405,000 $303,000 $301,000 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts