Question: got these both wrong. finacial calculator equations only for explanation 15 You have successfully started and operated a company for the past 10 years. You

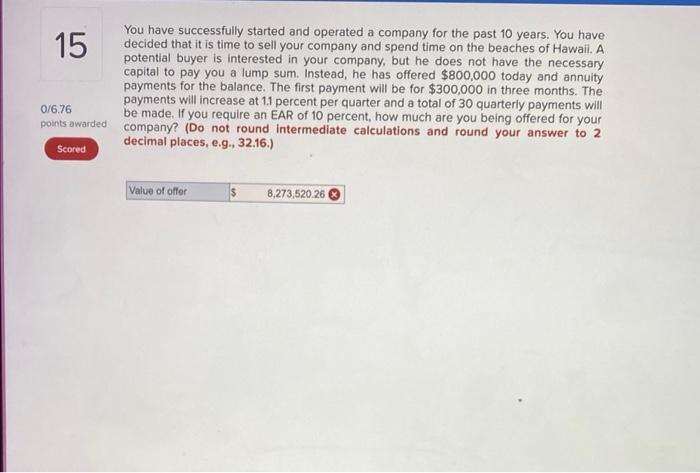

15 You have successfully started and operated a company for the past 10 years. You have decided that it is time to sell your company and spend time on the beaches of Hawali. A potential buyer is interested in your company, but he does not have the necessary capital to pay you a lump sum. Instead, he has offered $800,000 today and annuity a payments for the balance. The first payment will be for $300,000 in three months. The payments will increase at 1.1 percent per quarter and a total of 30 quarterly payments will 0/6.76 be made. If you require an EAR of 10 percent, how much are you being offered for your points awarded company? (Do not round intermediate calculations and round your answer to 2 Scored decimal places, e.g., 32.16.) Value of offer 8,273,520.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts