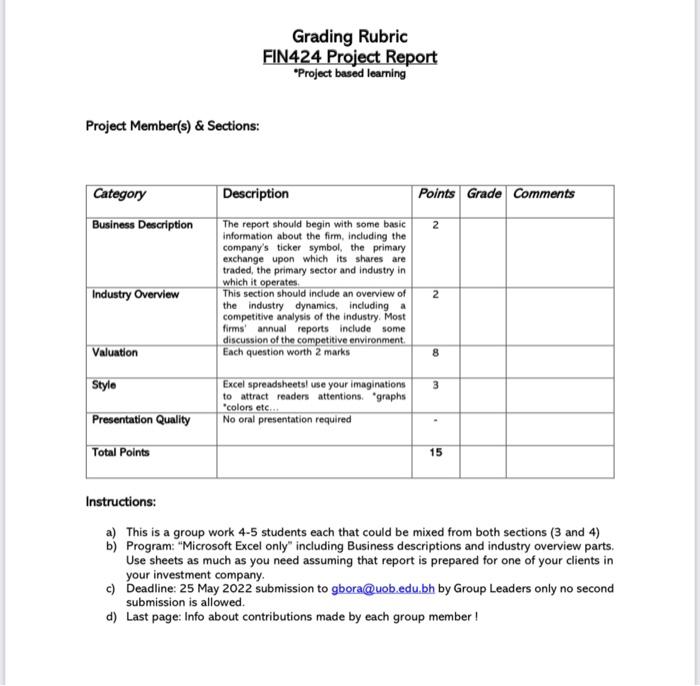

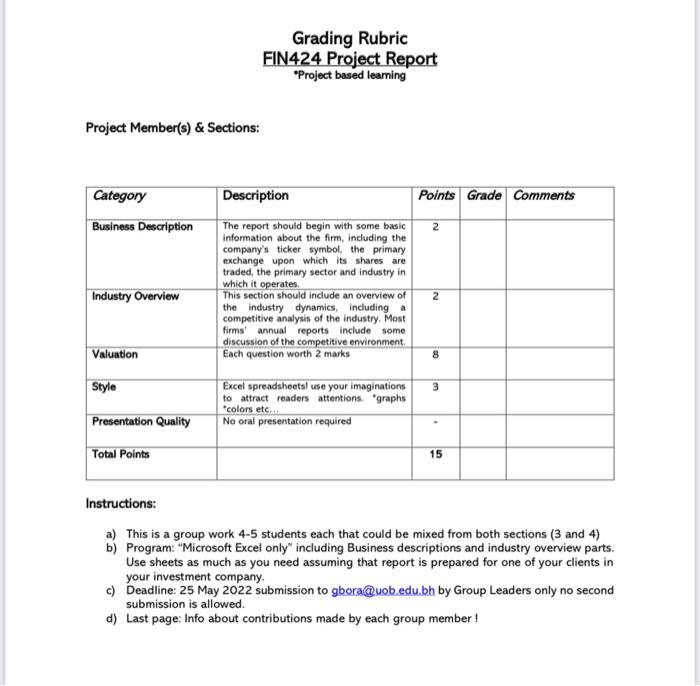

Question: Grading Rubric FIN424 Project Report Project based learning Project Member(s) & Sections: Description Points Grade Comments Category Business Description 2 Industry Overview The report should

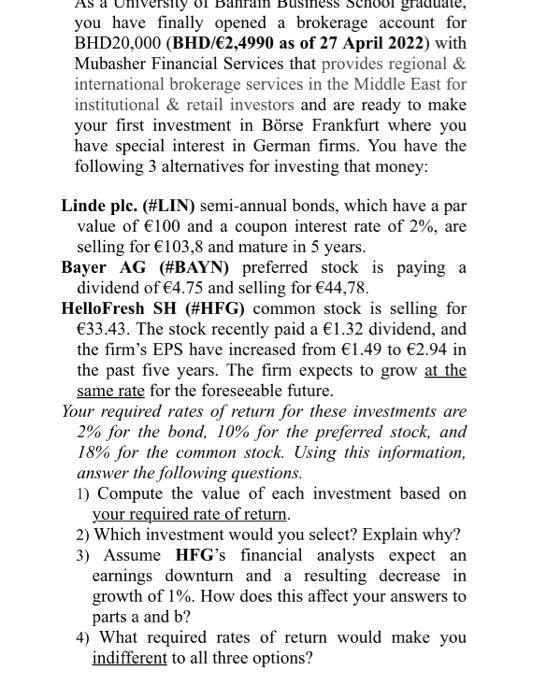

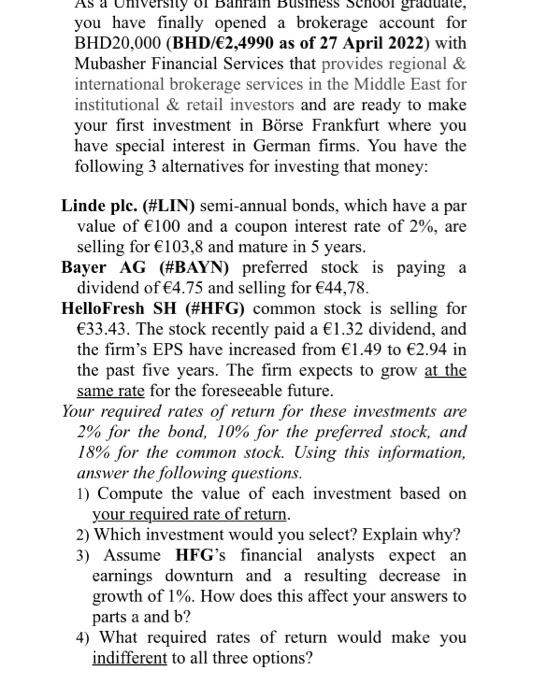

Grading Rubric FIN424 Project Report "Project based learning Project Member(s) & Sections: Description Points Grade Comments Category Business Description 2 Industry Overview The report should begin with some basic Information about the firm, including the company's ticker symbol, the primary exchange upon which its shares are traded, the primary sector and industry in which it operates This section should include an overview of the industry dynamics, including a competitive analysis of the industry. Most firms' annual reports include some discussion of the competitive environment Each question worth 2 marks 2 Valuation 8 Style 3 Excel spreadsheets use your imaginations to attract readers attentions graphs "colors etc... No oral presentation required Presentation Quality Total Points 15 Instructions: a) This is a group work 4-5 students each that could be mixed from both sections (3 and 4) b) Program: "Microsoft Excel only" including Business descriptions and industry overview parts. Use sheets as much as you need assuming that report is prepared for one of your clients in your investment company. c) Deadline: 25 May 2022 submission to gboraQuob.edu.bh by Group Leaders only no second submission is allowed. d) Last page: Info about contributions made by each group member! Tsity Sche gradu you have finally opened a brokerage account for BHD20,000 (BHD/2,4990 as of 27 April 2022) with Mubasher Financial Services that provides regional & international brokerage services in the Middle East for institutional & retail investors and are ready to make your first investment in Brse Frankfurt where you have special interest in German firms. You have the following 3 alternatives for investing that money: Linde plc. (#LIN) semi-annual bonds, which have a par value of 100 and a coupon interest rate of 2%, are selling for 103,8 and mature in 5 years. Bayer AG (#BAYN) preferred stock is paying a dividend of 4.75 and selling for 44,78. HelloFresh SH (#HFG) common stock is selling for 33.43. The stock recently paid a 1.32 dividend, and the firm's EPS have increased from 1.49 to 2.94 in the past five years. The firm expects to grow at the same rate for the foreseeable future. Your required rates of return for these investments are 2% for the bond, 10% for the preferred stock, and 18% for the common stock. Using this information, answer the following questions. 1) Compute the value of each investment based on your required rate of return. 2) Which investment would you select? Explain why? 3) Assume HFG's financial analysts expect an earnings downturn and a resulting decrease in growth of 1%. How does this affect your answers to parts a and b? 4) What required rates of return would make you indifferent to all three options? sity Scho grad you have finally opened a brokerage account for BHD20,000 (BHD/2,4990 as of 27 April 2022) with Mubasher Financial Services that provides regional & international brokerage services in the Middle East for institutional & retail investors and are ready to make your first investment in Brse Frankfurt where you have special interest in German firms. You have the following 3 alternatives for investing that money: Linde plc. (#LIN) semi-annual bonds, which have a par value of 100 and a coupon interest rate of 2%, are selling for 103,8 and mature in 5 years. Bayer AG (#BAYN) preferred stock is paying a dividend of 4.75 and selling for 44,78. HelloFresh SH (#HFG) common stock is selling for 33.43. The stock recently paid a 1.32 dividend, and the firm's EPS have increased from 1.49 to 2.94 in the past five years. The firm expects to grow at the same rate for the foreseeable future. Your required rates of return for these investments are 2% for the bond, 10% for the preferred stock, and 18% for the common stock. Using this information, answer the following questions. 1) Compute the value of each investment based on your required rate of return. 2) Which investment would you select? Explain why? 3) Assume HFG's financial analysts expect an earnings downturn and a resulting decrease in growth of 1%. How does this affect your answers to parts a and b? 4) What required rates of return would make you indifferent to all three options? Grading Rubric FIN424 Project Report Project based learning Project Member(s) & Sections: Description Points Grade Comments Category Business Description 2 Industry Overview The report should begin with some basic Information about the firm, including the company's ticker symbol, the primary exchange upon which its shares are traded, the primary sector and industry in which it operates This section should include an overview of the industry dynamics, including a competitive analysis of the industry. Most firms' annual reports include some discussion of the competitive environment Each question worth 2 marks 2 Valuation 8 Style 3 Excel spreadsheets use your imaginations to attract readers attentions. "graphs *colors etc... No oral presentation required Presentation Quality Total Points 15 Instructions: a) This is a group work 4-5 students each that could be mixed from both sections (3 and 4) b) Program: "Microsoft Excel only" including Business descriptions and industry overview parts. Use sheets as much as you need assuming that report is prepared for one of your clients in your investment company. c) Deadline: 25 May 2022 submission to gbora@uob.edu.bh by Group Leaders only no second submission is allowed d) Last page: Info about contributions made by each group member

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts