Question: Problem 1 A restaurant chain considers opening a new restaurant. A suitable lot could be acquired for $450,000. It would cost $300,000 to erect the

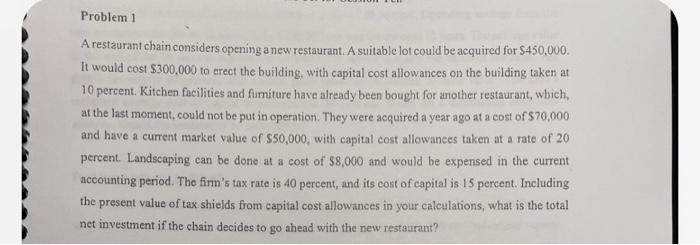

Problem 1 A restaurant chain considers opening a new restaurant. A suitable lot could be acquired for $450,000. It would cost $300,000 to erect the building, with capital cost allowances on the building taken at 10 percent. Kitchen facilities and fumiture have already been bought for another restaurant, which, at the last moment, could not be put in operation. They were acquired a year ago at a cost of $70,000 and have a current market value of $50,000, with capital cost allowances taken at a rate of 20 percent. Landscaping can be done at a cost of $8,000 and would be expensed in the current accounting period. The firm's tax rate is 40 percent, and its cost of capital is 15 percent. Including the present value of tax shields from capital cost allowances in your calculations, what is the total net investment if the chain decides to go ahead with the new restaurant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts