Question: Gradys Key Financial Indicator RATIO YEAR AGC INDUSTRY AVE. 2015 2016 2017 2018 2019 Revenue/Receivables 5.98 5.53 5.37 5.21 4.93 6.0 Days Receivable 61 66

Gradys Key Financial Indicator

| RATIO | YEAR | AGC INDUSTRY AVE. | ||||

| 2015 | 2016 | 2017 | 2018 | 2019 | ||

| Revenue/Receivables | 5.98 | 5.53 | 5.37 | 5.21 | 4.93 | 6.0 |

| Days Receivable | 61 | 66 | 68 | 70 | 74 | 61 |

| Days Payable | 53 | 55 | 53 | 48 | 44 | 54 |

| Net Fixed Assets/ Owners Equity | 0.81 | 0.67 | 0.72 | 0.71 | 0.64 | 0.2 |

| Debt-to-Equity Ratio | 1.1 | 1.3 | 1.6 | 2.2 | 2.1 | 3.2 |

| Net Profit Before Taxes/Owners Equity | 20.55% | 22.05% | 7.57% | 12.87% | 7.15% | 29.3% |

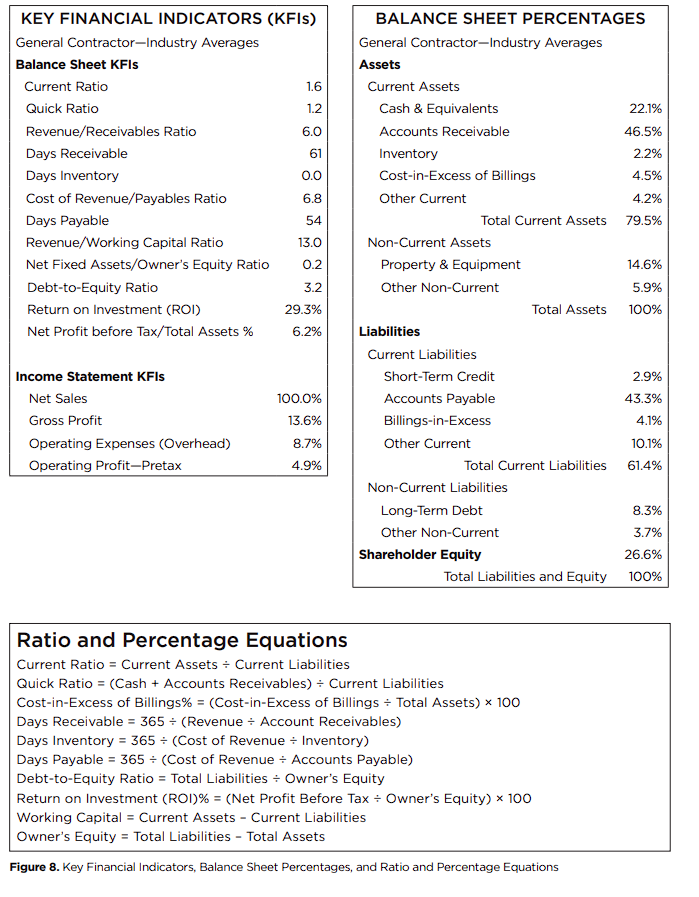

Identify the firms financial trends and compare the KFI data with AGCs industry baseline averages (Figure 8). Based on your analysis, answer the following questions: KFI Trends

1. What are the significant trends regarding the firms KFIs? What trends, if any, are of concern?

2. What are the likely drivers or causes of Gradys negative trends?

3. What actions should Grady consider to address the firms negative trends?

4. The company has been using its working capital to finance acquisition of equipment. Is this a good practice? What might be an alternative approach? Cost Reporting

5. Does Gradys current income statement provide an accurate picture of each SBUs performance? Should Grady make any changes regarding the format/organization of their income statement?

6. What actions should Grady consider both at the company level and at the project level to address the firms negative financial trends?

7. Does the current process of charging each project a fixed percentage of 7.7% of project cost for company overhead treat the public work projects fairly? How might the situation be addressed?

Ratio and Percentage Equations Current Ratio = Current Assets Current Liabilities Quick Ratio =( Cash + Accounts Receivables ) Current Liabilities Cost-in-Excess of Billings\% =( Cost-in-Excess of Billings Total Assets )100 Days Receivable =365 (Revenue Account Receivables) Days Inventory =365 (Cost of Revenue Inventory) Days Payable =365 (Cost of Revenue Accounts Payable) Debt-to-Equity Ratio = Total Liabilities Owner's Equity Return on Investment (ROI)%=( Net Profit Before Tax Owner's Equity )100 Working Capital = Current Assets - Current Liabilities Owner's Equity = Total Liabilities - Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts