Question: Grateful Eight Co. is expected to maintain a constant 6.2 percent growth rate in its dividends indefinitely. If the company has a dividend yield of

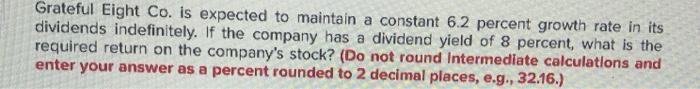

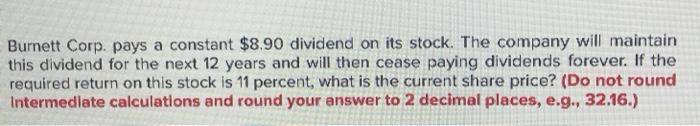

Grateful Eight Co. is expected to maintain a constant 6.2 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 8 percent, what is the required return on the company's stock? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Burnett Corp. pays a constant $8.90 dividend on its stock. The company will maintain this dividend for the next 12 years and will then cease paying dividends forever. If the required return on this stock is 11 percent, what is the current share price? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts