Question: Great feedback instant - for correct work - thanks Alexa and Sirri, both age 48, are married filing jointly. They have the following items for

Great feedback instant - for correct work - thanks

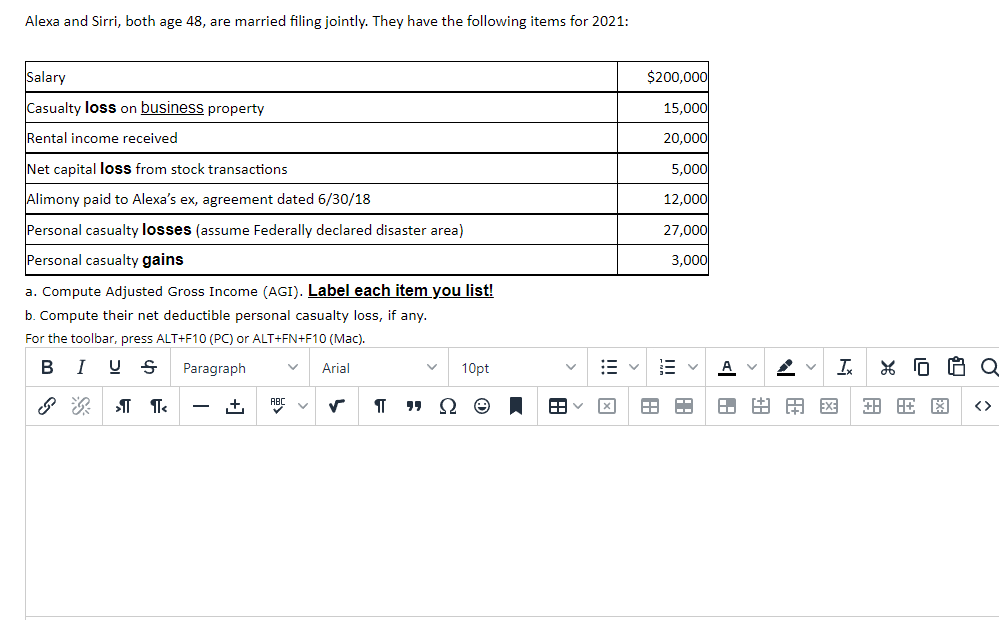

Alexa and Sirri, both age 48, are married filing jointly. They have the following items for 2021: Salary $200,000 15,000 Casualty loss on business property Rental income received 20,000 Net capital loss from stock transactions 5,000 12.000 Alimony paid to Alexa's ex, agreement dated 6/30/18 Personal casualty losses (assume Federally declared disaster area) 27,000 Personal casualty gains 3,000 a. Compute Adjusted Gross Income (AGI). Label each item you list! b. Compute their net deductible personal casualty loss, if any. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). U S Paragraph Arial 10pt Tk % od > IT + ABS V T 12 A TI E Ex: +: HE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts