Question: Green Co. from the U.S. is evaluating a proposal to build a new plant in the U.K. The expected cash flows in pounds are

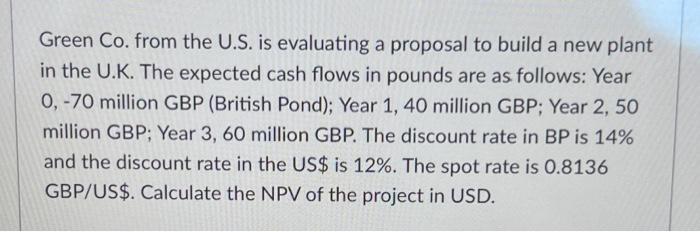

Green Co. from the U.S. is evaluating a proposal to build a new plant in the U.K. The expected cash flows in pounds are as follows: Year 0, -70 million GBP (British Pond); Year 1, 40 million GBP; Year 2, 50 million GBP; Year 3, 60 million GBP. The discount rate in BP is 14% and the discount rate in the US$ is 12%. The spot rate is 0.8136 GBP/US$. Calculate the NPV of the project in USD.

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Given Data Cash Flows in GBP Year 0 70 million Year 1 40 million Year 2 50 million Year ... View full answer

Get step-by-step solutions from verified subject matter experts