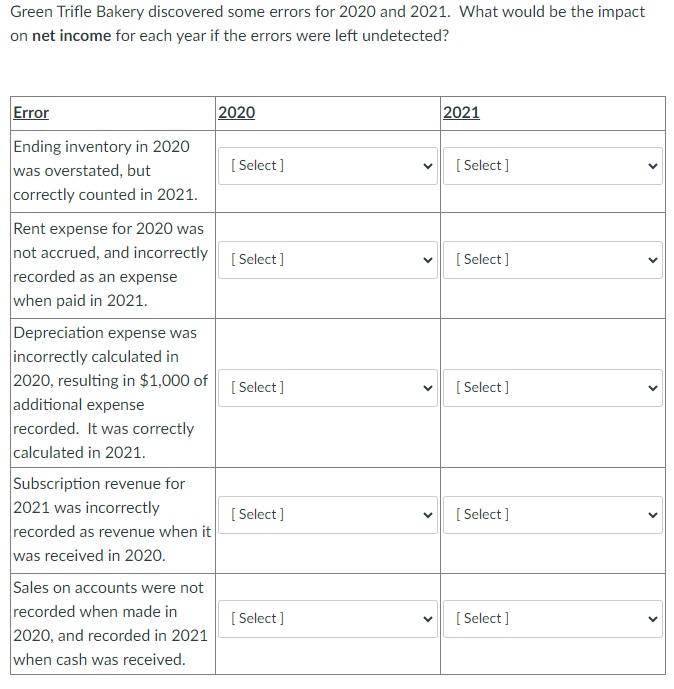

Question: Green Trifle Bakery discovered some errors for 2020 and 2021. What would be the impact on net income for each year if the errors

Green Trifle Bakery discovered some errors for 2020 and 2021. What would be the impact on net income for each year if the errors were left undetected? Error Ending inventory in 2020 2020 2021 was overstated, but [Select] [Select] correctly counted in 2021. Rent expense for 2020 was not accrued, and incorrectly recorded as an expense when paid in 2021. [Select] [Select] Depreciation expense was incorrectly calculated in 2020, resulting in $1,000 of [Select] [Select] additional expense recorded. It was correctly calculated in 2021. Subscription revenue for 2021 was incorrectly [Select] [Select] recorded as revenue when it was received in 2020. Sales on accounts were not recorded when made in [Select] [Select] 2020, and recorded in 2021 when cash was received. > > > >

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Lets analyze the impact of each error on the net income for 2020 and 2021 Error 1 Ending inventory i... View full answer

Get step-by-step solutions from verified subject matter experts