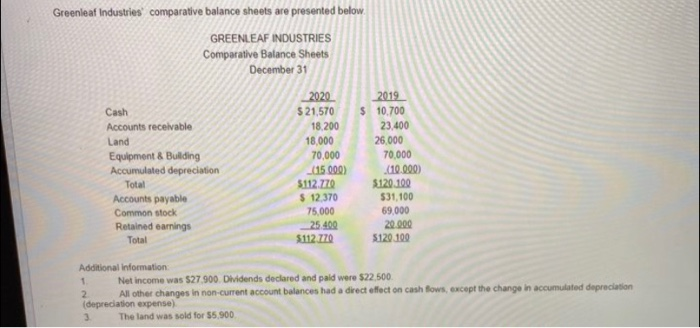

Question: Greenleaf Industries comparative balance sheets are presented below. GREENLEAF INDUSTRIES Comparative Balance Sheets December 31 2020 2019 Cash $ 21,570 $ 10.700 Accounts receivable 18,200

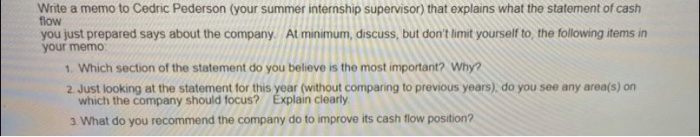

Greenleaf Industries comparative balance sheets are presented below. GREENLEAF INDUSTRIES Comparative Balance Sheets December 31 2020 2019 Cash $ 21,570 $ 10.700 Accounts receivable 18,200 23.400 Land 18,000 26.000 Equipment & Building 70,000 70.000 Accumulated depreciation _(15000) (10.000 Total $112.770 $120.100 Accounts payable $ 12.370 531,100 Common stock 75,000 69,000 Retained earnings 25 409 20.000 Total $112.770 $120.100 Additional Information 1 Net Income was 527 900. Dividends declared and paid were $22.500. 2 All other changes in non-current account balances had a direct effect on cash flows, except the change in accumulated depreciation (depreciation expense) 3 The land was sold for 55.900 Write a memo to Cedric Pederson (your summer internship supervisor) that explains what the statement of cash flow you just prepared says about the company. At minimum, discuss, but don't limit yourself to the following items in your memo 1. Which section of the statement do you believe is the most important? Why? 2. Just looking at the statement for this year (without comparing to previous years), do you see any area(s) on which the company should focus? Explain clearly 3. What do you recommend the company do to improve its cash flow position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts