Question: Greetings, Please support to answer the below question. Thank you 2018 Individual Tax Rates Single Individuals You Pay This Plus This Percentage If Your Taxable

Greetings,

Please support to answer the below question.

Thank you

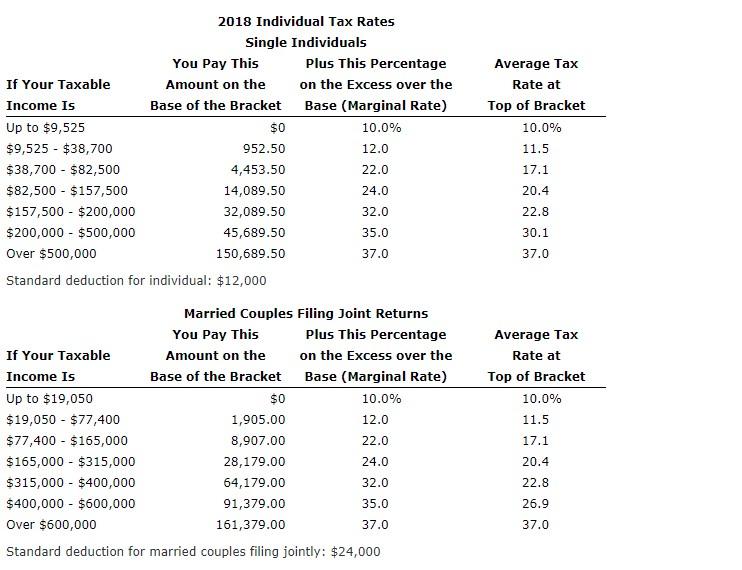

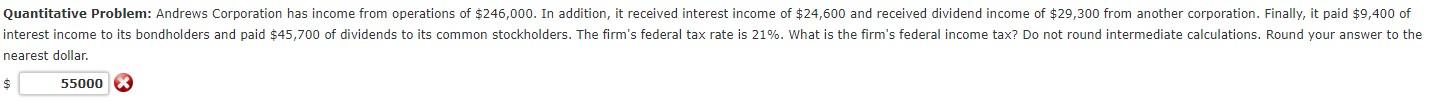

2018 Individual Tax Rates Single Individuals You Pay This Plus This Percentage If Your Taxable Amount on the on the Excess over the Income Is Base of the Bracket Base (Marginal Rate) Up to $9,525 $0 10.0% $9,525 - $38,700 952.50 12.0 $38,700 - $82,500 4,453.50 22.0 $82,500 - $157,500 14,089.50 24.0 $157,500 - $200,000 32,089.50 32.0 $200,000 - $500,000 45,689.50 35.0 Over $500,000 150,689.50 37.0 Standard deduction for individual: $12,000 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 30.1 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 Married couples Filing Joint Returns You Pay This Plus This Percentage If Your Taxable Amount on the on the Excess over the Income Is Base of the Bracket Base (Marginal Rate) Up to $19,050 $0 10.0% $19,050 - $77,400 1,905.00 12.0 $77,400 - $165,000 8,907.00 22.0 $165,000 - $315,000 28,179.00 24.0 $315,000 - $400,000 64,179.00 32.0 $400,000 - $600,000 91,379.00 35.0 Over $600,000 161,379.00 37.0 Standard deduction for married couples filing jointly: $24,000 17.1 20.4 22.8 26.9 37.0 Quantitative Problem: Andrews Corporation has income from operations of $246,000. In addition, it received interest income of $24,600 and received dividend income of $29,300 from another corporation. Finally, it paid $9,400 of interest income to its bondholders and paid $45,700 of dividends to its common stockholders. The firm's federal tax rate is 21%. What is the firm's federal income tax? Do not round intermediate calculations. Round your answer to the nearest dollar. $ 55000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts