Question: answer the question WITHOUT excel and PVIF . the only tools that can be used is a financial calculator. DO NOT USE excel. I will

answer the question WITHOUT excel and PVIF . the only tools that can be used is a financial calculator. DO NOT USE excel. I will report you to chegg customer service and give you bad rating. As this is the 3rd time ive posted this question and the 2 before used excel.

do NOT use PVIF

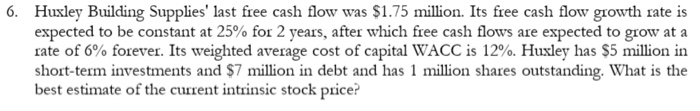

Huxley Building Supplies' last free cash flow was $1.75 million. Its free cash flow growth rate is expected to be constant at 25% for 2 years, after which free cash flows are expected to grow at a rate of 6% forever. Its weighted average cost of capital WACC is 12%. Huxley has $5 million in short-term investments and $7 million in debt and has 1 million shares outstanding. What is the best estimate of the current intrinsic stock price? 6

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock