Question: Group project: Work with your group and answer the following questions for the case studies indicated. First National Bank You have applied for a job

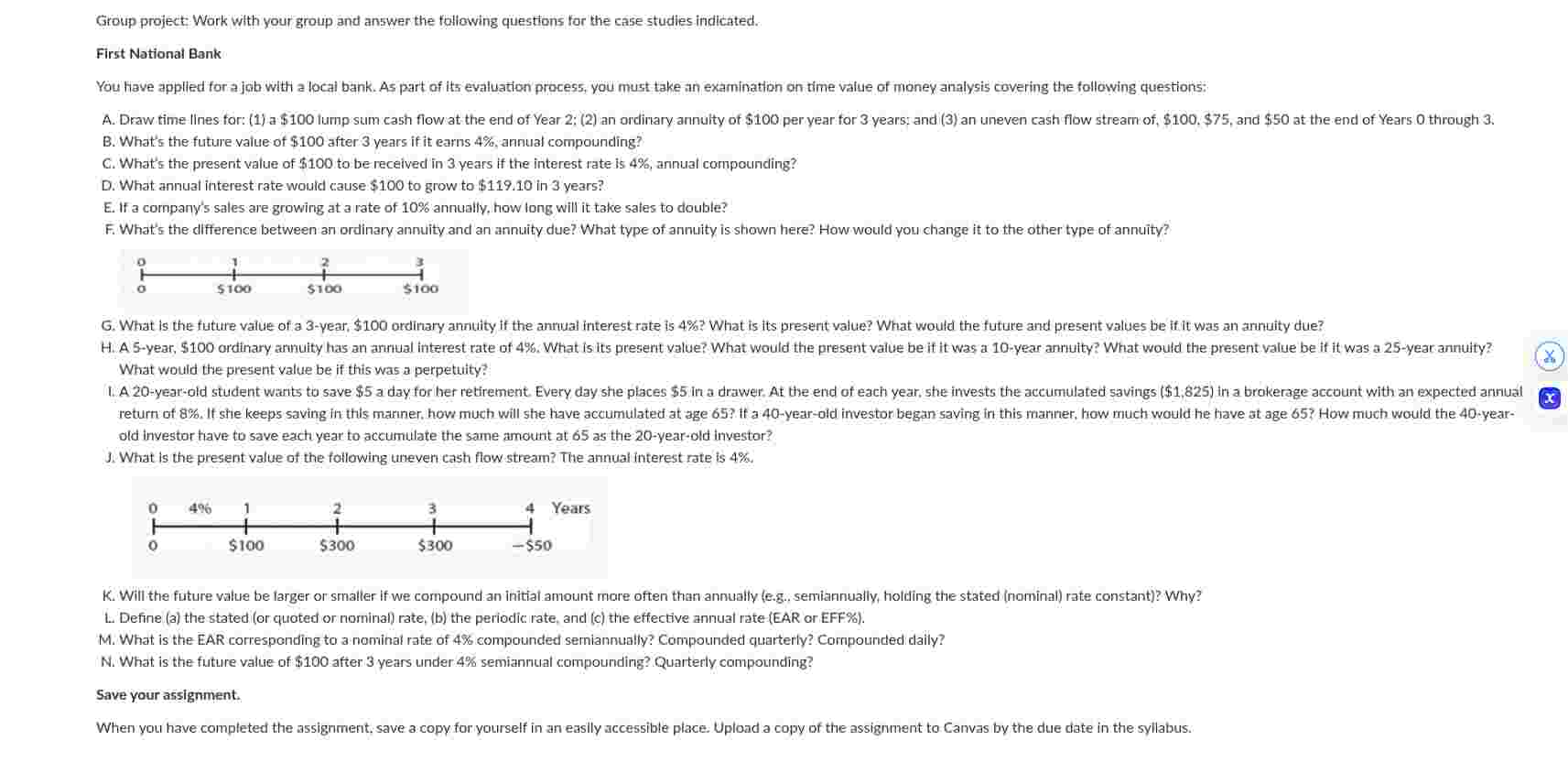

Group project: Work with your group and answer the following questions for the case studies indicated. First National Bank You have applied for a job with a local bank. As part of its evaluation process, you must take an examination on time value of money analysis covering the following questions: B What's the future value of $ after years if it earns annual compounding? C What's the present value of $ to be received in years if the interest rate is annual compounding? D What annual interest rate would cause $ to grow to $ in years? E If a company's sales are growing at a rate of annually, how long will it take sales to double? F What's the difference between an ordinary annuity and an annuity due? What type of annuity is shown here? How would you change it to the other type of annuity? G What is the future value of a year, $ ordinary annuity if the annual interest rate is What is its present value? What would the future and present values be if it was an antuity due? What would the present value be if this was a perpetuity? old investor have to save each year to accumulate the same amount at as the yearold investor? J What is the present value of the following uneven cash flow stream? The annual interest rate is K Will the future value be larger or smaller if we compound an initial amount more often than annually eg semiannually, holding the stated nominal rate constant Why? L Define a the stated or quoted or norninal rate, b the periodic: rate, and c the effective annual rate EAR or EFF M What is the EAR corresponding to a nominal rate of compounded semiannually? Compounded quarterly? Compounded claily? N What is the future value of $ after years under semiannual compounding? Quarterly compounding? Save your assignment. When you have completed the assignment, save a copy for yourself in an easily accessible place. Upload a copy of the assignment to Canvas by the due date in the syllabus.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock