Question: GST is 10% Part B Question 1 Using the information provided for Mitchie Leisure Centre, apply accounting principles and processes to: calculate depreciation using the

GST is 10%

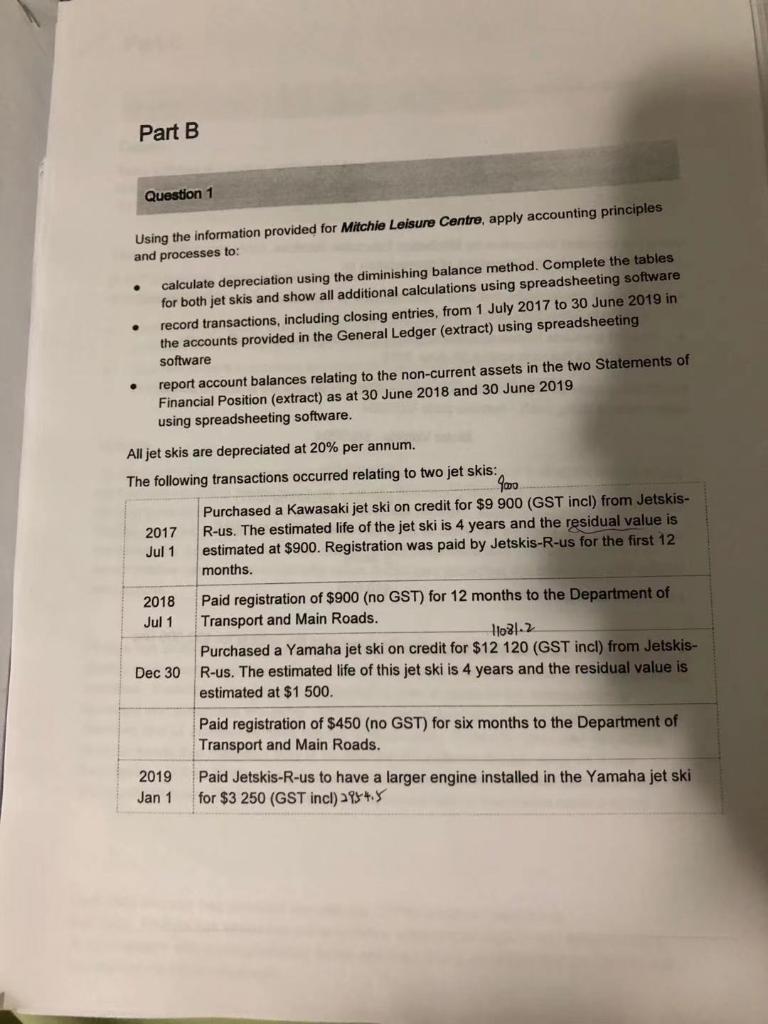

Part B Question 1 Using the information provided for Mitchie Leisure Centre, apply accounting principles and processes to: calculate depreciation using the diminishing balance method. Complete the tables for both jet skis and show all additional calculations using spreadsheeting software record transactions, including closing entries, from 1 July 2017 to 30 June 2019 in the accounts provided in the General Ledger (extract) using spreadsheeting software report account balances relating to the non-current assets in the two Statements of Financial Position (extract) as at 30 June 2018 and 30 June 2019 using spreadsheeting software. All jet skis are depreciated at 20% per annum. The following transactions occurred relating to two jet skis: 4000 Purchased a Kawasaki jet ski on credit for $9 900 (GST incl) from Jetskis- 2017 R-us. The estimated life of the jet ski is 4 years and the residual value is Jul 1 estimated at $900. Registration was paid by Jetskis-R-us for the first 12 months. 2018 Jul 1 Paid registration of $900 (no GST) for 12 months to the Department of Transport and Main Roads. 1021.2 Purchased a Yamaha jet ski on credit for $12 120 (GST incl) from Jetskis- R-us. The estimated life of this jet ski is 4 years and the residual value is estimated at $1 500 Dec 30 Paid registration of $450 (no GST) for six months to the Department of Transport and Main Roads. 2019 Jan 1 Paid Jetskis-R-us to have a larger engine installed in the Yamaha jet ski for $3 250 (GST incl) 2984.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts