Question: gst rate is 10% Using the information provided below for Famsham Enterprisus, apply accounting principles and processes to: a. Calculate depreciation on the office furniture

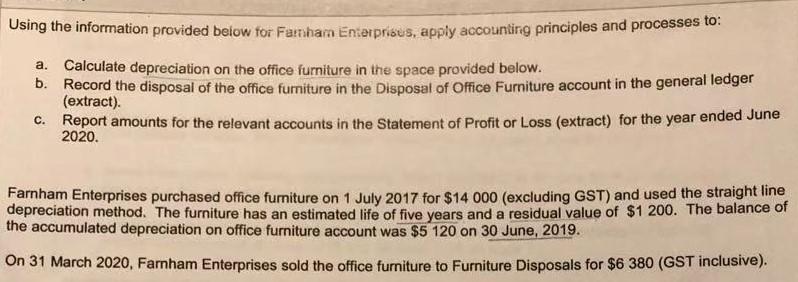

Using the information provided below for Famsham Enterprisus, apply accounting principles and processes to: a. Calculate depreciation on the office furniture in the space provided below. b. Record the disposal of the office furniture in the Disposal of Office Furniture account in the general ledger (extract). c. Report amounts for the relevant accounts in the Statement of Profit or Loss (extract) for the year ended June 2020. Farnham Enterprises purchased office furniture on 1 July 2017 for $14 000 (excluding GST) and used the straight line depreciation method. The furniture has an estimated life of five years and a residual value of $1 200. The balance of the accumulated depreciation on office furniture account was $5 120 on 30 June, 2019. On 31 March 2020, Farnham Enterprises sold the office furniture to Furniture Disposals for $6 380 (GST inclusive) Using the information provided below for Famsham Enterprisus, apply accounting principles and processes to: a. Calculate depreciation on the office furniture in the space provided below. b. Record the disposal of the office furniture in the Disposal of Office Furniture account in the general ledger (extract). c. Report amounts for the relevant accounts in the Statement of Profit or Loss (extract) for the year ended June 2020. Farnham Enterprises purchased office furniture on 1 July 2017 for $14 000 (excluding GST) and used the straight line depreciation method. The furniture has an estimated life of five years and a residual value of $1 200. The balance of the accumulated depreciation on office furniture account was $5 120 on 30 June, 2019. On 31 March 2020, Farnham Enterprises sold the office furniture to Furniture Disposals for $6 380 (GST inclusive)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts