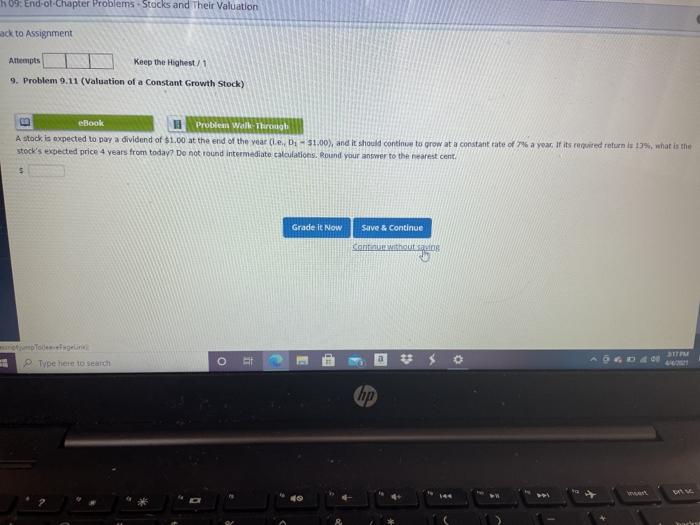

Question: h 09: End-ot Chapter Problems Stocks and Their Valuation ack to Assignment Attempts Keep the Highest 1 9. Problem 9.11 (Valuation of a Constant Growth

h 09: End-ot Chapter Problems Stocks and Their Valuation ack to Assignment Attempts Keep the Highest 1 9. Problem 9.11 (Valuation of a Constant Growth Stock) eBook Problem Walk Through A stock is expected to pay a dividend of $1.00 at the end of the year (16.02- 51.00), and it should continue to grow at a constant rate of a year. It is required return is 139, what is the stock's expected price 4 years from today? Do not Found intermediate calculations. Round your answer to the nearest cont. Grade it Now Save & Continue Cant without sang Toegen Type here to search a PM O hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts