Question: H i , can you help m e understand how I would arrive a t a n optimal highest and lowest price point for each

can you help understand how I would arrive optimal highest and lowest price point for each product being sold this exercise?

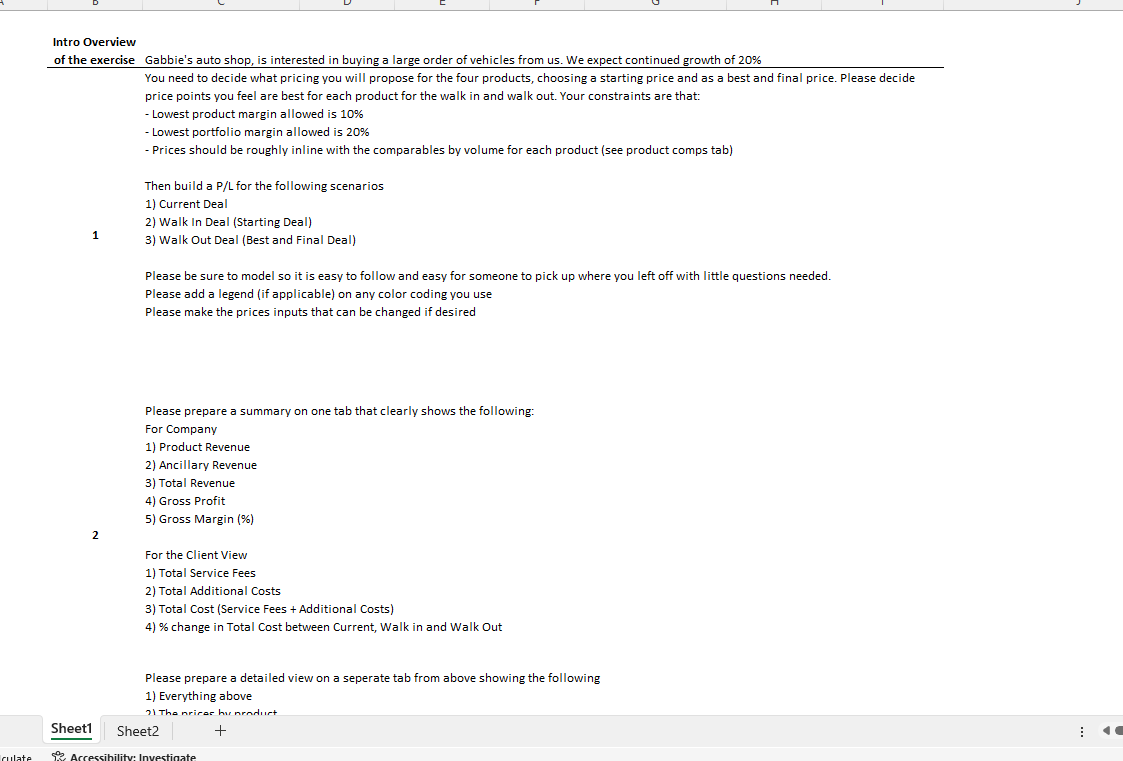

Intro Overview

the exercise Gabbie's auto shop, interested buying a large order vehicles from expect continued growth

You need decide what pricing you will propose for the four products, choosing a starting price and a best and final price. Please decide

price points you feel are best for each product for the walk and walk out. Your constraints are that:

Lowest product margin allowed

Lowest portfolio margin allowed

Prices should roughly inline with the comparables volume for each product product comps tab

Then build for the following scenarios

Current Deal

Walk Deal Deal

Walk Out Deal and Final Deal

Please sure model easy follow and easy for someone pick where you left off with little questions needed.

Please add a legend applicable any color coding you use

Please make the prices inputs that can changed desired

Please prepare a summary one tab that clearly shows the following:

For Company

Product Revenue

Ancillary Revenue

Total Revenue

Gross Profit

Gross Margin

For the Client View

Total Service Fees

Total Additional Costs

Total Cost Fees Additional Costs

change Total Cost between Current, Walk and Walk Out

Please prepare a detailed view a seperate tab from above showing the following

Everything above

Please prepare a detailed view a seperate tab from above showing the following

Everything above

The prices product

The margin product

The profit product

The Revenue product the total revenue

$

$

$

$

$

$

$

$

$

$

$

$$

$

$

$

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock