Question: H i everyone! need help w hw:) Pls show work as well Problem 2. (20 points) Bob's risk preference is represented by the following expected

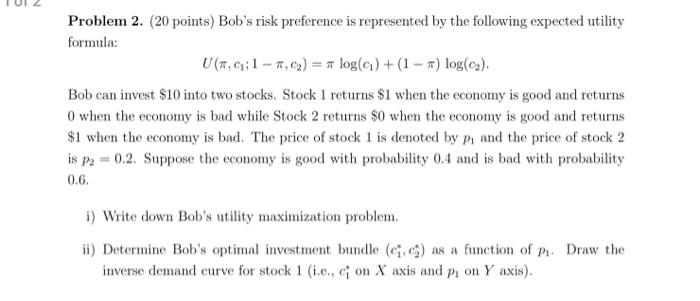

Problem 2. (20 points) Bob's risk preference is represented by the following expected utility formula: U(1,6;1 - 7,0x) = * log(a) + (1 - 1) log(cz). Bob can invest $10 into two stocks. Stock I returns $1 when the economy is good and returns O when the economy is bad while Stock 2 returns $0 when the economy is good and returns $1 when the economy is bad. The price of stock 1 is denoted by p, and the price of stock 2 is p2 = 0.2. Suppose the economy is good with probability 0.4 and is bad with probability 0.6. 1) Write down Bob's utility maximization problem. ii) Determine Bob's optimal investment bundle (c) as a function of pl Draw the inverse demand curve for stock 1 (i.e., on X axis and mon Y axis). Problem 2. (20 points) Bob's risk preference is represented by the following expected utility formula: U(1,6;1 - 7,0x) = * log(a) + (1 - 1) log(cz). Bob can invest $10 into two stocks. Stock I returns $1 when the economy is good and returns O when the economy is bad while Stock 2 returns $0 when the economy is good and returns $1 when the economy is bad. The price of stock 1 is denoted by p, and the price of stock 2 is p2 = 0.2. Suppose the economy is good with probability 0.4 and is bad with probability 0.6. 1) Write down Bob's utility maximization problem. ii) Determine Bob's optimal investment bundle (c) as a function of pl Draw the inverse demand curve for stock 1 (i.e., on X axis and mon Y axis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts