Question: . h such other instruments as may be declared by the Central Government to be securities and i rights or interest in securities . Sweat

.

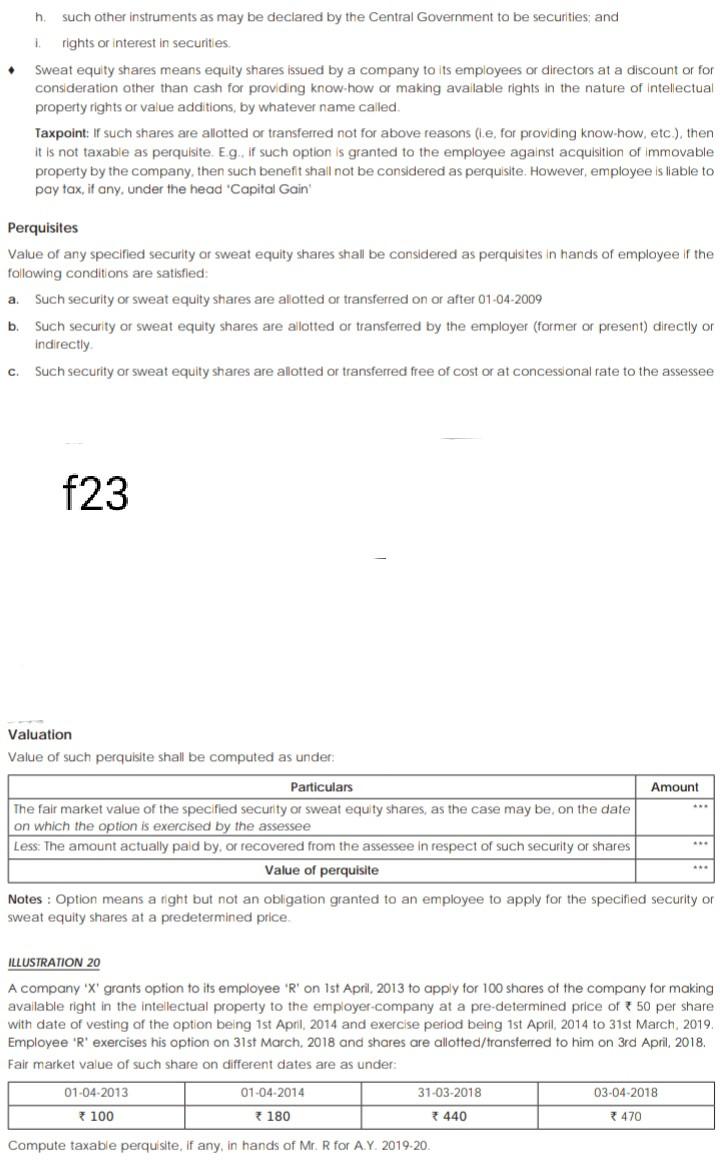

h such other instruments as may be declared by the Central Government to be securities and i rights or interest in securities . Sweat equity shares means equity shares issued by a company to its employees or directors at a discount or for consideration other than cash for providing know-how or making available rights in the nature of intelectual property rights or value additions, by whatever name called Taxpoint: If such shares are allotted or transferred not for above reasons (le, for providing know-how, etc.), then it is not taxable as perquisite. Eg, if such option is granted to the employee against acquisition of immovable property by the company, then such benefit shall not be considered as perquisite. However, employee is liable to pay tax, if any, under the head 'Capital Gain Perquisites Value of any specified security or sweat equity shares shall be considered as perquisites in hands of employee if the following conditions are satisfied: Such security or sweat equity shares are alotted or transferred on or after 01-04-2009 b. Such security of sweat equity shares are allotted or transferred by the employer (former or present) directly or Indirectly Such security or sweat equity shares are alotted or transferred free of cost or at concessional rate to the assessee a C. f23 Valuation Value of such perquisite shall be computed as under: Amount Particulars The fair market value of the specified security or sweat equity shares, as the case may be, on the date on which the option is exercised by the assessee Less: The amount actually paid by, or recovered from the assessee in respect of such security or shares Value of perquisite Notes : Option means a night but not an obligation granted to an employee to apply for the specified security or sweat equity shares at a predetermined price ILLUSTRATION 20 A company 'X' grants option to its employee 'R' on 1st April, 2013 to apply for 100 shares of the company for making available right in the intellectual property to the employer-company at a pre-determined price of 50 per share with date of vesting of the option being 1st April, 2014 and exercise period being 1st April 2014 to 31st March, 2019 Employee 'R' exercises his option on 31st March, 2018 and shares are allotted/transferred to him on 3rd April, 2018. Fair market value of such share on different dates are as under: 01-04-2013 01-04-2014 180 31-03-2018 440 03-04-2018 * 470 100 Compute taxable perquisite, if any, in hands of Mr. R for A.Y 2019-20Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock