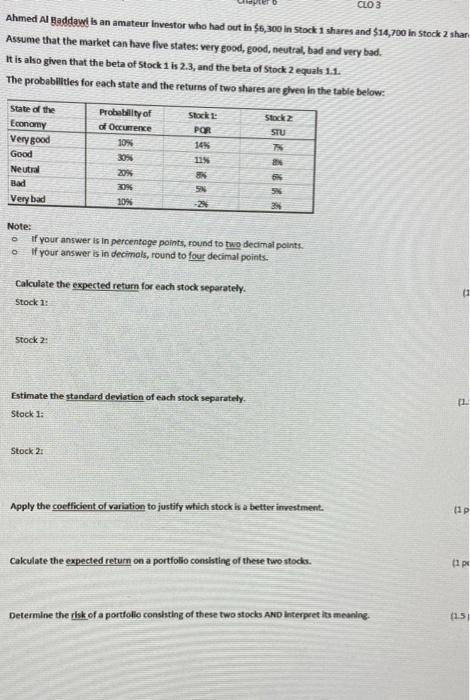

Question: hact hy site Type here to search E+ > 1100 C03 Ahmed Al Baddad is an amateur Investor who had out in $6,300 in Stock

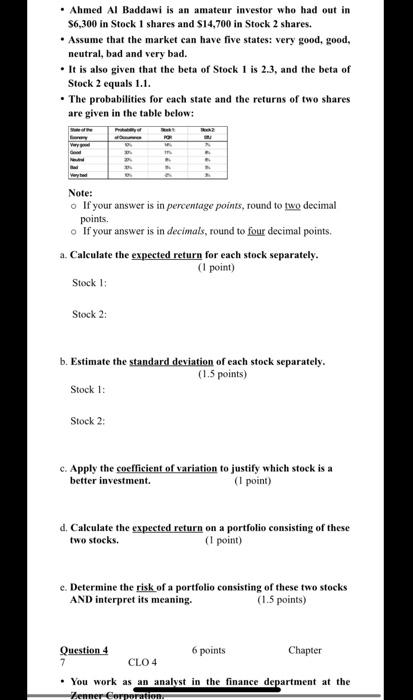

hact hy site Type here to search E+ > 1100 C03 Ahmed Al Baddad is an amateur Investor who had out in $6,300 in Stock 1 shares and $14,700 in Stock 2 shan Assume that the market can have five states: very good, good, neutral, bad and very bad. It is also given that the beta of Stock 1 is 2.3, and the beta of Stock 2 equals 1.1. The probabilities for each state and the returns of two shares are given in the table below: State of the Probability of Stockt: Stocka Economy of Occurrence POR STU Very good 14 Good 115 es Neutral 20% 5 Bad 30% 5 Very bad 10% 10% 30% Note: if your answer is in percentage points, round to two decimal points. if your answer is in decimals, round to four decimal points. Calculate the expected return for each stock separately. Stock 1: Stock 2: Estimate the standard deviation of each stock separately Stock 1: 2 Stock 2: Apply the coefficient of variation to justify which stock is a better investment. DP Cakulate the expected return on a portfolio consisting of these two stocks. ap Determine the risk of a portfolio consting of these two stocks and interpret its meaning 015 Ahmed Al Baddawi is an amateur investor who had out in $6,300 in Stock 1 shares and S14,700 in Stock 2 shares. Assume that the market can have five states: very good, good, neutral, bad and very bad. . It is also given that the beta of Stock 1 is 2.3, and the beta of Stock 2 equals 1.1. The probabilities for each state and the returns of two shares are given in the table below: . Vay Very Note: o If your answer is in percentage points, round to two decimal points. If your answer is in decimals, round to four decimal points. a. Calculate the expected return for each stock separately. (1 point) Stock 1: Stock 2: b. Estimate the standard deviation of each stock separately. (1.5 points) Stock 1: Stock 2: c. Apply the coefficient of variation to justify which stock is a better investment (1 point) d Calculate the expected return on a portfolio consisting of these two stocks. (1 point) e. Determine the risk of a portfolio consisting of these two stocks AND interpret its meaning. (1.5 points) Question 4 6 points Chapter 7 CLO4 You work as an analyst in the finance department at the Zenner Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts