Question: half question D E PRODUCT Contibutio 2019% prc 2020 % pre Weighted a Total units Weighted sold p.a. 80,000 90,000 Sales units Sales units Sales

half question

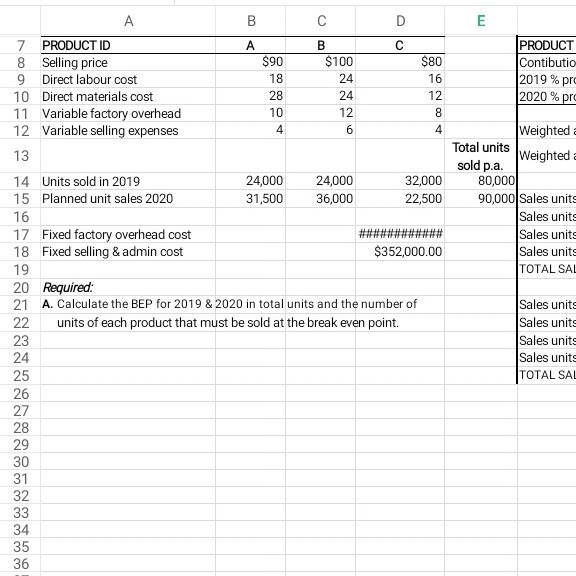

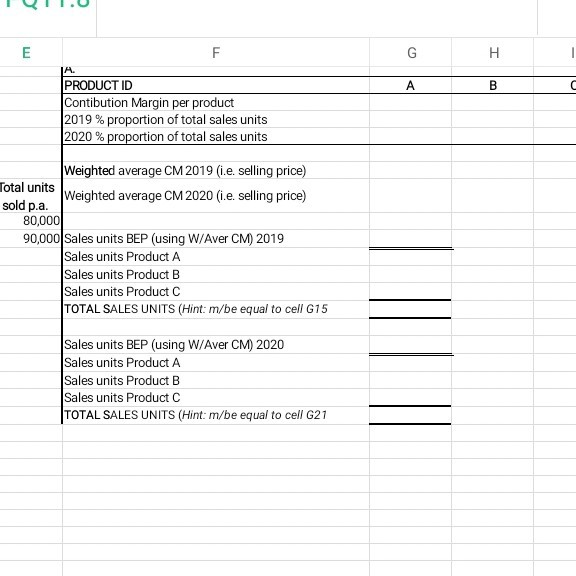

D E PRODUCT Contibutio 2019% prc 2020 % pre Weighted a Total units Weighted sold p.a. 80,000 90,000 Sales units Sales units Sales units Sales units TOTAL SAL B C 7 PRODUCT ID A B 8 Selling price $90 $100 $80 9 Direct labour cost 18 24 16 10 Direct materials cost 28 24 12 11 Variable factory overhead 10 12 8 12 Variable selling expenses 4 6 4 13 14 Units sold in 2019 24,000 24,000 32,000 15 Planned unit sales 2020 31,500 36,000 22,500 16 17 Fixed factory overhead cost 18 Fixed selling & admin cost $352,000.00 19 20 Required: 21 A. Calculate the BEP for 2019 & 2020 in total units and the number of 22 units of each product that must be sold at the break even point. 23 24 25 26 27 28 29 30 31 32 33 34 35 36 Sales units Sales units Sales units Sales units TOTAL SAL E G H B F IA PRODUCT ID Contibution Margin per product 2019 % proportion of total sales units 2020 % proportion of total sales units Weighted average CM 2019 (i.e. selling price) Total units Weighted average CM 2020 (i.e. selling price) sold p.a. 80,000 90,000 Sales units BEP (using W/Aver CM) 2019 Sales units Product A Sales units Product B Sales units Product C TOTAL SALES UNITS (Hint: m/be equal to cell G15 Sales units BEP (using W/Aver CM) 2020 Sales units Product A Sales units Product B Sales units Product C TOTAL SALES UNITS (Hint: m/be equal to cell G21 D E PRODUCT Contibutio 2019% prc 2020 % pre Weighted a Total units Weighted sold p.a. 80,000 90,000 Sales units Sales units Sales units Sales units TOTAL SAL B C 7 PRODUCT ID A B 8 Selling price $90 $100 $80 9 Direct labour cost 18 24 16 10 Direct materials cost 28 24 12 11 Variable factory overhead 10 12 8 12 Variable selling expenses 4 6 4 13 14 Units sold in 2019 24,000 24,000 32,000 15 Planned unit sales 2020 31,500 36,000 22,500 16 17 Fixed factory overhead cost 18 Fixed selling & admin cost $352,000.00 19 20 Required: 21 A. Calculate the BEP for 2019 & 2020 in total units and the number of 22 units of each product that must be sold at the break even point. 23 24 25 26 27 28 29 30 31 32 33 34 35 36 Sales units Sales units Sales units Sales units TOTAL SAL E G H B F IA PRODUCT ID Contibution Margin per product 2019 % proportion of total sales units 2020 % proportion of total sales units Weighted average CM 2019 (i.e. selling price) Total units Weighted average CM 2020 (i.e. selling price) sold p.a. 80,000 90,000 Sales units BEP (using W/Aver CM) 2019 Sales units Product A Sales units Product B Sales units Product C TOTAL SALES UNITS (Hint: m/be equal to cell G15 Sales units BEP (using W/Aver CM) 2020 Sales units Product A Sales units Product B Sales units Product C TOTAL SALES UNITS (Hint: m/be equal to cell G21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts