Question: hamada equation pls answer clearly thank u! Excel Online Structured Activity: Hamada equation Situational Software Co. (SSC) is trying to establish its optimal capital structure.

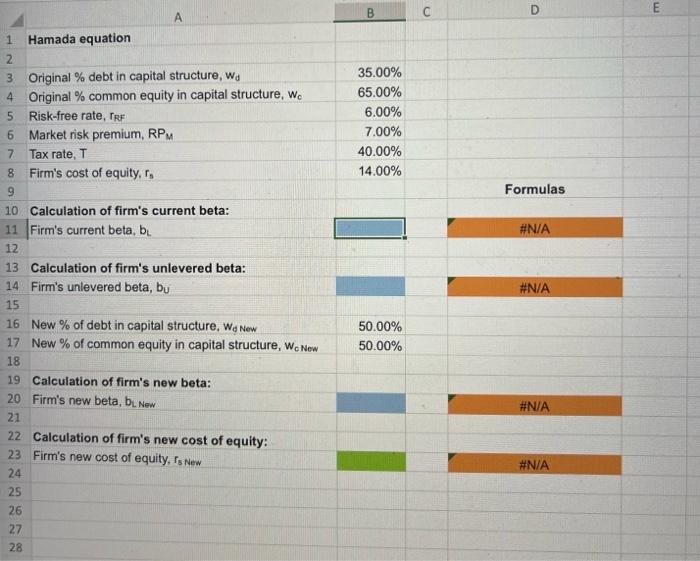

Excel Online Structured Activity: Hamada equation Situational Software Co. (SSC) is trying to establish its optimal capital structure. Its current capital structure consists of 35% debt and 65% equity; however, the CEO believes that the firm should use more debt. The risk-free rate, rP%, is 6%; the market risk premium, RPP, is 7%; and the firm's tax rate is 40%. Currently, SSC's cost of equity is 14%, which is determined by the CAPM. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What would be SSC's estimated cost of equity if it changed its capital structure to 50% debt and 50% equity? Round your answer to two decimal places. Do not round intermedlate steps. % Hamada equation \begin{tabular}{|l|r|} \hline Original % debt in capital structure, wd & 35.00% \\ \hline Original % common equity in capital structure, wc & 65.00% \\ \hline Risk-free rate, rRF F & 6.00% \\ \hline Market risk premium, RP & 7.00% \\ \hline Tax rate, T & 40.00% \\ \hline Firm's cost of equity, rs & 14.00% \\ \hline \end{tabular} Calculation of firm's current beta: Firm's current beta, bL. B D E A \begin{tabular}{r} \hline \\ \hline 35.00% \\ 65.00% \\ 6.00% \\ 7.00% \\ 40.00% \\ 14.00% \end{tabular} Formulas Calculation of firm's unlevered beta: Firm's unlevered beta, bu \#N/A \#N/A \#N/A New % of debt in capital structure, wd New New % of common equity in capital structure, wc New 50.00% Calculation of firm's new beta: Firm's new beta, bLNow 50.00% Calculation of firm's new cost of equity: Firm's new cost of equity, rsNew Excel Online Structured Activity: Hamada equation Situational Software Co. (SSC) is trying to establish its optimal capital structure. Its current capital structure consists of 35% debt and 65% equity; however, the CEO believes that the firm should use more debt. The risk-free rate, rP%, is 6%; the market risk premium, RPP, is 7%; and the firm's tax rate is 40%. Currently, SSC's cost of equity is 14%, which is determined by the CAPM. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What would be SSC's estimated cost of equity if it changed its capital structure to 50% debt and 50% equity? Round your answer to two decimal places. Do not round intermedlate steps. % Hamada equation \begin{tabular}{|l|r|} \hline Original % debt in capital structure, wd & 35.00% \\ \hline Original % common equity in capital structure, wc & 65.00% \\ \hline Risk-free rate, rRF F & 6.00% \\ \hline Market risk premium, RP & 7.00% \\ \hline Tax rate, T & 40.00% \\ \hline Firm's cost of equity, rs & 14.00% \\ \hline \end{tabular} Calculation of firm's current beta: Firm's current beta, bL. B D E A \begin{tabular}{r} \hline \\ \hline 35.00% \\ 65.00% \\ 6.00% \\ 7.00% \\ 40.00% \\ 14.00% \end{tabular} Formulas Calculation of firm's unlevered beta: Firm's unlevered beta, bu \#N/A \#N/A \#N/A New % of debt in capital structure, wd New New % of common equity in capital structure, wc New 50.00% Calculation of firm's new beta: Firm's new beta, bLNow 50.00% Calculation of firm's new cost of equity: Firm's new cost of equity, rsNew

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts